TSMC, ASML May Win The Chip War, Says Expert, But Nvidia And Intel Could Feel The Heat From Trump Tariffs

A semiconductor expert on AlphaSense broke down the industry’s shifting dynamics with tariffs, trade wars, and other geopolitical uncertainties. While not named by the platform, the expert drew clear lines between those who are poised to win big amid this chaos and those who stand to lose.

What Happened: On Wednesday, AlphaSense, a market intelligence platform that helps analysts and researchers meet subject-matter experts, shared the transcript of one such interaction between an analyst and an expert in the semiconductor industry on its X account.

The expert, who previously worked for Nvidia Corp. (NASDAQ:NVDA), says the tariffs will hurt all technology companies across the board. The reason for this, they say, is the “potential erosion of demand,” as tariffs have an inflationary effect, impacting consumer purchasing power.

They, however, believe that companies like the Taiwan Semiconductor Manufacturing Co. (NYSE:TSM) are at a much more favorable position relative to peers. This is because TSMC manufactures 90% of the world’s advanced chips, and is thus a beneficiary of President Donald Trump’s recent exemptions on electronics imports.

Because China considers Taiwan a part of its territory, it hasn't imposed tariffs on imports from the island, a factor that further benefits TSMC. With no manufacturing facilities in the U.S., the chipmaker is uniquely positioned to serve customers in China, the U.S., and globally, with minimal trade barriers.

Besides this, the expert sees the deterioration of relationships between the U.S. and the E.U. as an advantage for fab equipment maker ASML Holding NV (NASDAQ:ASML), allowing it to freely sell to customers in China, from where it already derives close to 40% of its sales annually.

The expert views the tariffs as a net negative for Nvidia, particularly in light of China's new export restrictions, which are expected to create a bottleneck for the company's high-end chips. Intel Corp. (NASDAQ:INTC) is also seen as vulnerable, with them suggesting that it stands to lose on both fronts of the escalating trade tensions.

Why It Matters: There has been a flurry of activity in the semiconductor industry in recent weeks, with major players like TSMC announcing plans to invest $100 billion to begin chip production within the United States.

China saw this coming early this year, with Zhu Fenglian, spokesperson for Beijing's Taiwan Affairs Office, taking a jab at TSMC, warning that it could soon be called the “United States Semiconductor Manufacturing Co.,” suggesting that the Taiwanese government was selling out domestic companies for political backing from the U.S. government.

While Nvidia remains caught in the crosshairs between China and the United States, some analysts are doubling down on the stock, despite the new AI diffusion rules and H20 export ban. According to BoFA analyst Vivek Arya, the company’s global footprint, alongside the growing sales of Blackwell Ultra GPUs, should help offset any major impact.

Price Action: Shares of Nvidia were up 3.86% yesterday, trading at $102.71, followed by TSMC at 157.81, up 4.20%. ASMV Holding and Intel were up 3.02% and 5.54%, respectively.

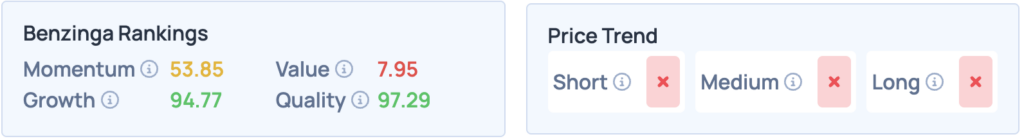

Nvidia scores high on growth and quality, but low on momentum and value, according to Benzinga’s Edge Stock Rankings. What about TSMC, Intel, and ASML? Sign up for Benzinga Edge to find out more.

Image Via Shutterstock

Wall Street Journal

Wall Street Journal