China's Chip Breakthrough Without ASML Makes Chamath Palihapitiya Take Stock Of Beijing's 'Formidable' Nature: 'America Can Win If…'

China's reported breakthrough in producing 5-nanometer chips without extreme ultraviolet (EUV) lithography has sparked warnings from tech leaders.

What Happened: On Wednesday, William Huo, Intel Corp's (NASDAQ:INTC) first chief representative in Beijing, took to X, formerly Twitter, and highlighted the report that China's Semiconductor Manufacturing International Corporation (SMIC) had manufactured 5 nm-class chips without using EUV tools.

"BREAKING: China made 5nm chips without EUV. Let that sink in," Huo wrote. "No ASML. No Nikon. Just brute-force DUV, clever engineering, and sheer industrial will."

He credited the milestone to advanced deep ultraviolet (DUV) techniques and innovations like Self-Aligned Quadruple Patterning (SAQP), calling the result "Moore's Law by force, not finesse."

Huo said that these chips are symbolic of China's resilience against U.S. sanctions and its emergence as a self-reliant chip powerhouse.

Responding to Huo's thread on the platform, venture capitalist Chamath Palihapitiya added his own stark assessment, saying, "There is one, and only one, battle that must be won… Technical Superiority."

"Countries who have technical superiority will have military and economic superiority over those that don't… China is formidable and neck and neck with America, but America can win if we focus and prioritize."

The "SPAC King" warned that America could lose its edge if it continues to favor bureaucracy and red tape over actual innovation and scaling.

Why It's Important: Last month, Wccftech cited industry insiders and reported that SMIC is expected to complete its 5nm chip development by 2025.

However, the manufacturing cost of these chips could be up to 50% higher than that of Taiwan Semiconductor Manufacturing Co. (NYSE:TSM), largely due to SMIC’s inability to access advanced EUV tools.

As per the report, SMIC’s yield rates for 5nm wafers are roughly one-third of what TSMC achieves on comparable technology. Despite these challenges, Huawei Technologies is said to be planning to incorporate SMIC's 5nm chips into its Ascend 910C AI processors.

This is part of broader efforts to reduce dependence on Nvidia Corporation (NASDAQ:NVDA) and boost domestic capabilities.

While reporting its first-quarter financial results, TSMC said, “Moving into second quarter 2025, we expect our business to be supported by strong demand for our industry-leading 3nm and 5nm technologies,” referring to the continuing demand for these chips.

Earlier this month, the White House enacted a permanent export restriction on Nvidia's H20 chips to China, a move that the company says could impact its quarterly revenue by as much as $5.5 billion.

This is part of the U.S. government’s efforts to bring advanced chip manufacturing back home. A key piece of the puzzle is cutting-edge technology like EUV lithography from Dutch company ASML Holdings (NASDAQ:ASML), which is essential for producing smaller, more powerful chips.

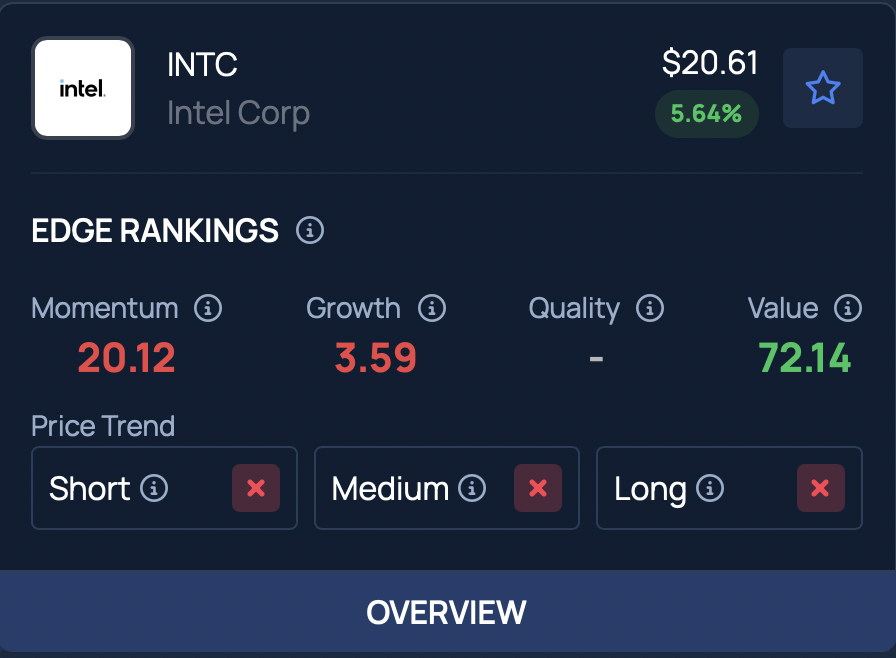

Intel earns a growth rating of 3.59% from Benzinga Edge Stock Rankings. Click here to compare its performance with TSMC, Nvidia, and other leading tech giants.

Read More:

Photo Courtesy: Maxx-Studio On Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Wall Street Journal

Wall Street Journal