Halliburton Analysts Cut Their Forecasts After Q1 Results

Halliburton Company (NYSE:HAL) reported better-than-expected first-quarter sales on Tuesday.

The company reported a revenue decline of 6.7% year-over-year to $5.417 billion, beating the consensus of $5.283 billion. Adjusted EPS came in at $0.60, down from $0.76 a year earlier and in line with analyst expectations, according to Benzinga Pro.

Completion and Production revenue fell 7.5% YoY to $3.12 billion, with $531 million operating income. The decline was driven by weaker pressure pumping and tool sales in the Western Hemisphere, partially offset by gains in the Middle East.

Drilling and Evaluation revenue declined 6% YoY to $2.3 billion, with operating income down 12% YoY to $352 million. Lower drilling and project activity in Mexico and the Middle East drove the drop, partly offset by stronger fluid services in the region.

Halliburton shares fell 0.3% to trade at $20.63 on Wednesday.

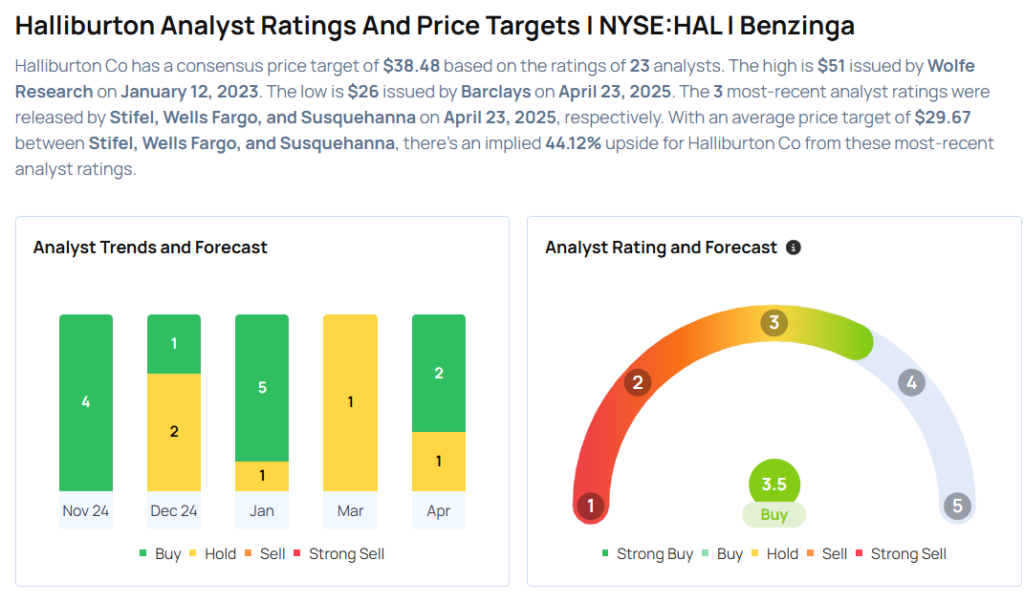

These analysts made changes to their price targets on Halliburton following earnings announcement.

- Susquehanna analyst Charles Minervino maintained Halliburton with a Positive rating and lowered the price target from $32 to $30.

- Barclays analyst David Anderson maintained the stock with an Equal-Weight rating and lowered the price target from $29 to $26.

- Wells Fargo analyst Roger Read maintained Halliburton with an Overweight rating and lowered the price target from $29 to $27.

- Stifel analyst Stephen Gengaro maintained Halliburton with a Buy and lowered the price target from $37 to $32.

Considering buying HAL stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Wall Street Journal

Wall Street Journal