Expert Outlook: Bank of Hawaii Through The Eyes Of 4 Analysts

4 analysts have shared their evaluations of Bank of Hawaii (NYSE:BOH) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 1 | 3 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 0 | 0 | 0 | 1 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 1 | 0 |

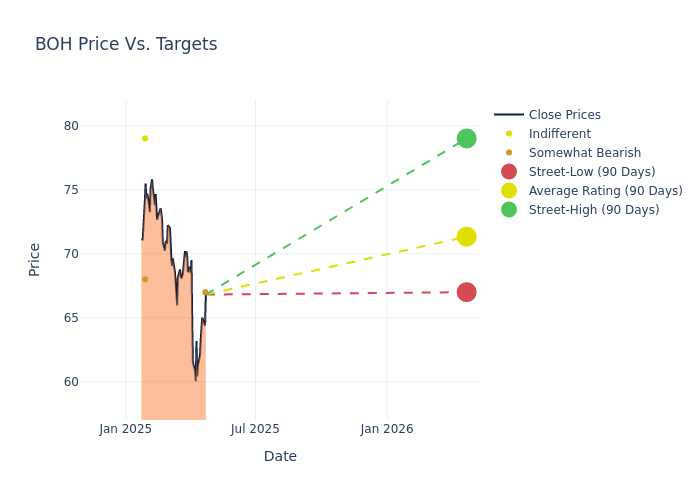

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $69.5, along with a high estimate of $79.00 and a low estimate of $64.00. Marking an increase of 2.58%, the current average surpasses the previous average price target of $67.75.

Breaking Down Analyst Ratings: A Detailed Examination

An in-depth analysis of recent analyst actions unveils how financial experts perceive Bank of Hawaii. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Jared Shaw |Barclays |Raises |Underweight | $67.00|$64.00 | |Jared Shaw |Barclays |Lowers |Underweight | $64.00|$66.00 | |Jeff Rulis |DA Davidson |Raises |Neutral | $79.00|$75.00 | |Andrew Liesch |Piper Sandler |Raises |Underweight | $68.00|$66.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Bank of Hawaii. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Bank of Hawaii compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Bank of Hawaii's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Bank of Hawaii's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Bank of Hawaii analyst ratings.

Discovering Bank of Hawaii: A Closer Look

Bank of Hawaii Corp provides a broad range of financial products and services predominantly to customers in Hawaii, Guam, and other Pacific Islands. The Bank's subsidiaries are engaged in equipment leasing, securities brokerage, investment advisory services, and providing credit insurance. It is organized into three business segments for management reporting purposes: Consumer Banking, Commercial Banking, and Treasury and Other. Majority of the revenue is generated from Consumer Banking segment which offers a broad range of financial products and services, including loan, deposit and insurance products; private banking and international client banking services; trust services; investment management; and institutional investment advisory services.

Understanding the Numbers: Bank of Hawaii's Finances

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Over the 3M period, Bank of Hawaii showcased positive performance, achieving a revenue growth rate of 3.21% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: Bank of Hawaii's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 20.99%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Bank of Hawaii's ROE stands out, surpassing industry averages. With an impressive ROE of 2.56%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Bank of Hawaii's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.14%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Bank of Hawaii's debt-to-equity ratio stands notably higher than the industry average, reaching 0.49. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyst Ratings: Simplified

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal