Medtronic (NYSE:MDT) Gains FDA Approval for Advanced Insulin Sensor in 2025

Medtronic (NYSE:MDT) recently announced the FDA approval for its Simplera Sync sensor, enhancing the MiniMed 780G system with significant technological advancements. Over the past week, Medtronic's share price remained flat, moving in line with broader market trends, which saw a 1.1% decline. Despite the positive product-related news, the share price was likely influenced by market dynamics, as the overall market context played a substantial role in Medtronic's performance. While the company's innovation could have supported its stock, it did little to counteract the prevailing trends affecting the market as a whole.

Buy, Hold or Sell Medtronic? View our complete analysis and fair value estimate and you decide.

Find companies with promising cash flow potential yet trading below their fair value.

The recent FDA approval for Medtronic's Simplera Sync sensor, a significant enhancement to the MiniMed 780G system, highlights Medtronic's commitment to technological advancements. While the approval has yet to translate into immediate share price growth, it aligns well with Medtronic's long-term strategy of expanding its Cardiac Ablation Solutions and other innovative platforms such as the Hugo robotic system.

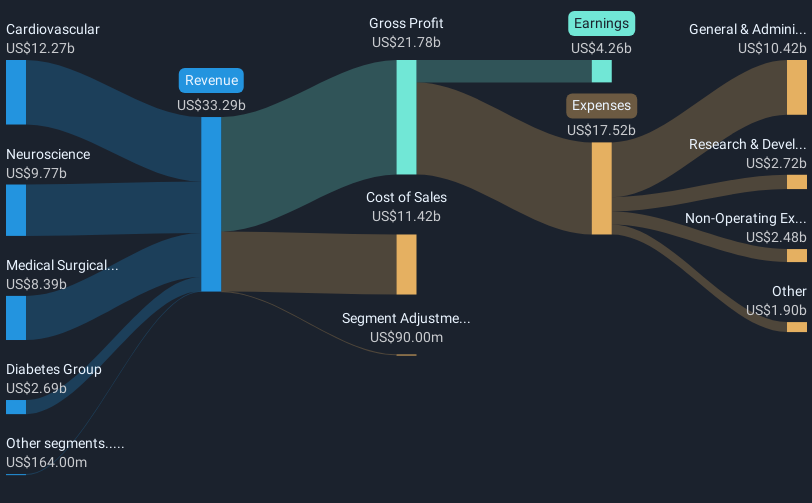

Over the past year, Medtronic's total return, which includes both share price and dividends, increased by 7.44%. This occurs as the company continues to focus on emerging markets like India and innovations such as the Renal Denervation technique, positioning itself for future revenue increases. Comparatively, the company matched the US Medical Equipment industry, which returned 4.5% over one year and underperformed the broader US market return of 5.9% over the same period.

The market's muted response to the FDA approval may have been influenced by current market dynamics, but the potential for higher future revenue and earnings remains. Analyst forecasts suggest revenue growth to US$38.2 billion by 2028, with earnings reaching US$6.1 billion, while Medtronic's shares trade at a discount compared to the analyst price target of US$96.83, with the current share price around 15% lower at US$82.7. If future clinical and regulatory milestones are met, the resulting revenue impact could help Medtronic achieve the forecasted growth and justify the analyst consensus price target. However, competitive pressures and regulatory dynamics remain variables to monitor closely.

Examine Medtronic's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal