Easter Candy Sticker Shock: Trump Tariffs And Climate Threaten to Make Your Chocolate Bunny A Luxury Item

Chocolate lovers are in for a rude awakening this Easter, with their favorite bars, cherished brands, and even the iconic Cadbury Creme Egg are significantly dearer compared to prior years.

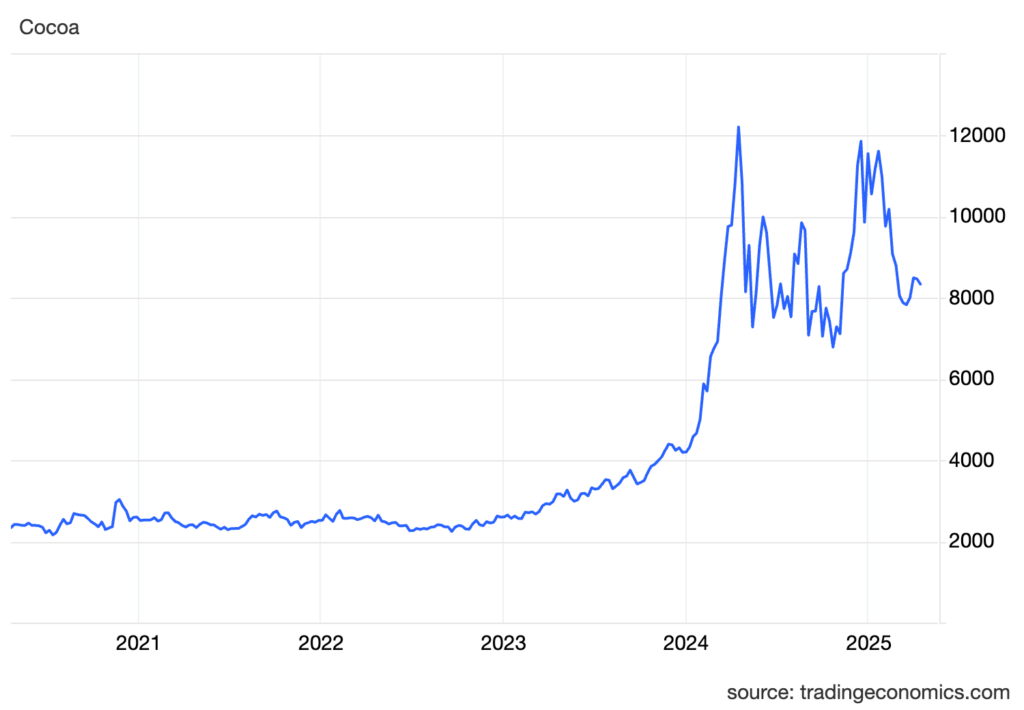

The 370% rally in cocoa prices, from $2,600 a ton in 2023 to $12,200 in April 2024, is more than just a bitter pill for consumers. It is weighing on the entire supply chain, from farmers and traders to confectionery giants and small chocolatiers alike.

While prices have stabilized this year, they are still well above historic averages at $7,750 a ton, and analysts warn that there is little relief on the horizon.

Turmoil In West Africa – Poor Weather, Crop Failures & Floods

The world produces nearly 6 million tonnes of cocoa beans each year, with two-thirds of them coming from the West African nations of Ghana and Ivory Coast. Starting with the 2022-23 cocoa season, however, the region has been hit by a perfect storm of floods, crop failures, and shifting weather patterns.

According to the International Cocoa Association, the global market has faced three consecutive years of deficit, the latest being a 150,000 tonne deficit during the 2024-25 season.

Following devastating floods that wiped out key growing regions, the extra dry Harmattan season roasted the cocoa pods, according to a report by ING Group analysts. Harmattan refers to dusty easterly or north-easterly winds on the West African coast that prevail between December to February.

To make matters worse, nearly 600,000 hectares of the 1.4 million hectares of land in Ghana that is under cocoa production has been infected with Swollen Foot Virus, which affects cocoa trees, harming their yield, and ultimately killing them, according to Reuters.

Chart representing Cocoa prices in USD per Tonne: source: tradingeconomics.com

Even as the dust settles on these issues, climate change-driven shifting weather patterns are threatening to destroy West Africa's cocoa industry for good.

Max Dugan-Knight, a climate data scientist at Deep Sky, a Canadian carbon capture startup, says that cocoa is grown in tropical climates, but persistent temperatures above 90°F kill cocoa trees. Both Ivory Coast and Ghana now see extended periods above these thresholds every year.

Climate change is causing more extreme heat, extreme precipitation, and larger swings between hot and cold and wet and dry. None of that is good for crops like cocoa, he adds.

Tariffs & Other Structural Issues

While critical problems continue to persist across key areas of the supply, new structural issues have since cropped up, further adding to the complexity of this crisis.

With just two days left for Easter, the White House is planning its annual Easter Egg Roll, a time-honored tradition going back nearly 150 years. The event will use 30,000 real eggs, but for those who want to celebrate with chocolate Easter Bunnies and eggs, things aren't as festive.

Recently, the U.S. Government imposed reciprocal tariffs of 21% on the Ivory Coast and 10% on Ghana, making cocoa more expensive for importers and chocolate producers located in the United States. To make matters worse, no region in the U.S. besides small parts of Hawaii is suitable for cultivating cocoa.

Shrinkflation Takes Hold of Big Chocolate

The big chocolate and confectionery companies such as Hershey Co. (NYSE:HSY) and Mondelez International Inc. (NASDAQ:MDLZ), which owns Cadbury's, have come under pressure from rising raw material prices, but not to the extent that was expected.

While cocoa prices have rallied over 300%, Hershey's has raised prices by 12% to 13% for some products, Mondelez by less than 10% for its chocolate products, while other popular brands such as Lindt & Spruengli AG have hiked prices by 6.5%.

According to the consumer price index, the retail price of chocolate has increased by 3% over the past year. A part of this was owing to the extensive hedging strategies and long-term contracts used by the big companies to handle volatility, but that doesn't last very long.

As cocoa prices show no signs of retreating, companies have begun employing other strategies to maintain their prices and margins in the long run.

This includes a reduction in product sizes, or ‘Shrinkflation,' along with changing formulations, with some products now labeled “chocolatey” or “chocolate flavored” to reflect reduced cocoa content, according to a report by Bloomberg.

Small Craft Chocolatiers Are Doing Better

Smaller craft chocolatiers see an opportunity in this crisis and are using their unique niche positioning to pass on the costs to consumers.

According to Chaitanya Muppala, the CEO of Manam Chocolate, an Indian craft chocolate brand focused on ethical sourcing and sustainability, "Given that for many companies the cacao content is going to change to cushion the volatility, this stands as an opportunity for us to truly familiarize people with premium quality, world-class chocolate."

Muppala adds that fine flavor cacao that craft chocolatiers work with has always traded at a premium to bulk cacao, and while the gap has narrowed, it still trades at a considerable premium. "We don't bother much about spot cacao prices," he says.

According to Carla Martin, director of the Fine Cacao and Chocolate Institute at Harvard University, there are 400 specialty chocolate companies in the U.S., a number that has doubled since 2017. She now worries that the rising prices alongside the new tariffs by the Trump administration could kill this nascent industry, as reported by The Marketplace.

Easter Bunnies: More Expensive Than Ever, Not Getting Any Cheaper

Chocolate Easter bunnies, already costlier to produce due to their intricate shapes, are expected to see price increases, with German manufacturers reporting bunnies are 2 to 3 times more expensive than regular chocolate bars, according to a report by DW.

Cocoa's rally has turned a holiday indulgence into a bellwether for climate resilience and trade policy. Whether the industry can channel record prices into better farm incomes and sustainable replanting will determine if the current boom ends in relief, or another meltdown the following Easter.

Photo Courtesy: LenaAndPhoto via Shutterstock.com

Read Next:

Wall Street Journal

Wall Street Journal