CarMax Stock Got Clobbered 17% in One Day. Is the Stock a Buy Now?

CarMax (NYSE: KMX) stock had a rough Thursday last week after the company reported weaker-than-expected earnings. It was a seemingly perfect storm of negativity: finding investor sentiment declining, missing analysts' estimates, and pulling its guidance for long-term growth.

But the used-car retailer had been trading at a premium. Is it now a buying opportunity?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Hitting a speed bump

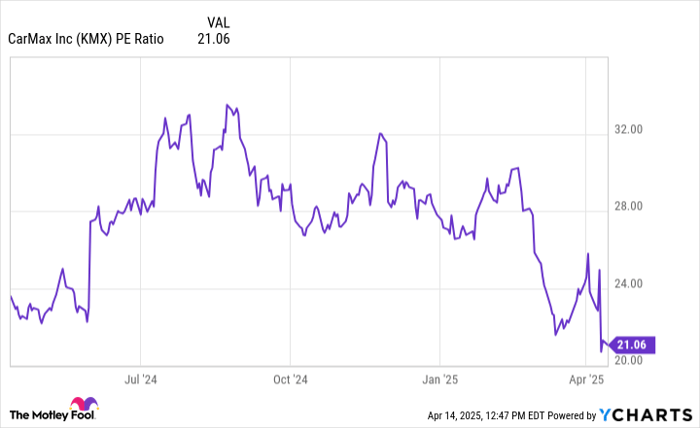

CarMax hit a speed bump the day of its fourth-quarter earnings conference call, as it shed 17% of its value in one trading day. In fact, the results might have brought the stock back into buyable territory after its price-to-earnings (P/E) ratio sank to a one-year low:

KMX PE Ratio data by YCharts.

How you saw the company's fourth quarter could depend on whether you're a "glass half-full" or "glass half-empty" type of person. On one hand, CarMax's earnings per share (EPS) checked in with a massive 81% increase compared to the prior year, at $0.58 per share. On the other, its EPS still missed analyst estimates calling for $0.66 (per FactSet).

Other news wasn't all bad. Net revenue jumped 6.7% to $6 billion, while retail used unit sales and comparable-store used unit sales increased a similar 6.2% and 5.1%, respectively. The used-car retailer even gained momentum during the back half of the year, helping offset a more challenging first half.

CarMax operates in a highly fragmented market; in 2024 it captured a 3.7% share of the nationwide market for used vehicles aged 0 to 10. The retailer also posted improved per-vehicle metrics, including gross profit per retail used unit of $2,322, which was good enough to set a fourth-quarter record.

Another good sign was found in the company's online results. Online retail sales accounted for 15% of retail unit sales, up from the prior year's fourth quarter. Online transactions, including retail and wholesale units, generated roughly 29% of revenue.

The silver lining

The stock market has been hit hard by numerous tariff announcements made by President Donald Trump. But the silver lining for CarMax investors is that the impact of tariffs could provide the company a little boost in sales: The prices of new vehicles, especially imported ones, are set to rise as automakers pass some of those costs onto consumers.

"I think it will push some folks into looking at used cars, late-model used cars, which is interesting because that's what we're seeing a lot of interest in right now," CarMax CEO William Nash said last Thursday, according to Barron's. "Now, I think over time what could happen is that the used car prices will also go up."

Despite missing estimates, the company received a couple votes of confidence from analysts. William Blair analyst Sharon Zackfia reiterated an outperform rating on CarMax, noting that missing estimates didn't undermine solid sales momentum and profit growth. CFRA Research analyst Garrett Nelson went as far as moving CarMax's rating from buy to strong buy, saying the company would be "one of the biggest winners from the impact of tariffs on the new vehicle market and consumers trading down to lower-cost used vehicles."

CarMax has sales momentum in its favor, and a growing online presence. It could benefit from the impact of tariffs on new vehicles. And it's trading at its cheapest P/E ratio in over a year.

The drawback is that if the U.S. faces a recession, many investors would rather avoid owning almost anything in the automotive industry. It might be wiser to watch CarMax stock from the sidelines.

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CarMax. The Motley Fool has a disclosure policy.

Wall Street Journal

Wall Street Journal