State Street (NYSE:STT) Reports Q1 Earnings Rise With US$100 Million Buyback Completion

State Street (NYSE:STT) recently reported its first-quarter 2025 results, highlighting a substantial increase in net income and earnings per share compared to the previous year, along with an ongoing share repurchase program. During the week following the earnings announcement and buyback update, the company's stock price moved up by 2.86%. This increase aligns with broader market stability, as overall market performance has been relatively flat over the past week. The positive financial results and continued buyback activity likely added weight to the stock's upward movement, indicating resilience amidst the market's general steadiness.

We've identified 2 possible red flags for State Street that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

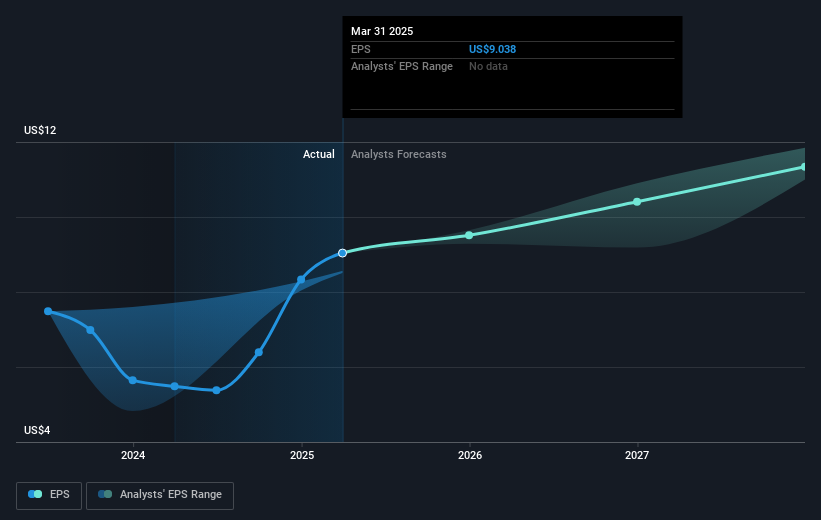

State Street's recent announcement of substantial increases in net income and earnings per share, alongside its share repurchase program, strengthens the narrative of financial growth and resilience. These results, paired with an ongoing buyback strategy, are significant for future revenue and earnings forecasts. The operational enhancements and emphasis on capital efficiency, such as automation and returning a high percentage of earnings to shareholders, are poised to support further enhancements to shareholder value.

Over the last five years, State Street shareholders experienced a total return of 67.57%. Comparatively, the company's performance in the past year has underperformed the US Capital Markets industry, which posted a return of 13.7%. This longer-term gain showcases the company's capability to deliver substantial returns, outpacing the broader market's one-year performance of 4.6%.

With the current share price positioned at $79.63 and the consensus analyst price target at $103.23, the recent price movement suggests that market participants are optimistic about closing this valuation gap. The anticipated improvements in State Street's revenue and earnings could justify this target. However, the elevated PE ratio assumption in the analysts' forecast implies a belief in substantial future growth and efficiency gains, highlighting the pivotal role of continued operational advancements and market share expansion.

Explore historical data to track State Street's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal