Ford Motor (NYSE:F) Amends Credit Agreements with US$16 Billion in Commitments

Ford Motor (NYSE:F) experienced a 5% price movement last week, which aligns with a flat market trajectory over the same period. This movement comes amid Ford's significant updates to its debt financing arrangements, including the Twenty-Second Amendment to its Credit Agreement, an extension of maturity dates, and emphasis on sustainability-linked terms. These financing shifts aim to enhance financial flexibility, offering broader stability despite market stagnation. While the broader market remains flat, Ford's active debt management strategies might add weight to the company's stability focus, contributing to its relative price performance alongside existing market trends.

The announcement of Ford Motor's updated credit arrangements and sustainability emphasis could potentially bolster the company's narrative by enhancing financial agility and stability. With a total shareholder return of 149.54% over the last five years, Ford's long-term performance underscores a resilient appreciation in shareholder value, despite recent volatility. Over the past year, however, Ford underperformed both the broader US market's 5.7% return and the Auto industry's 46.5% growth.

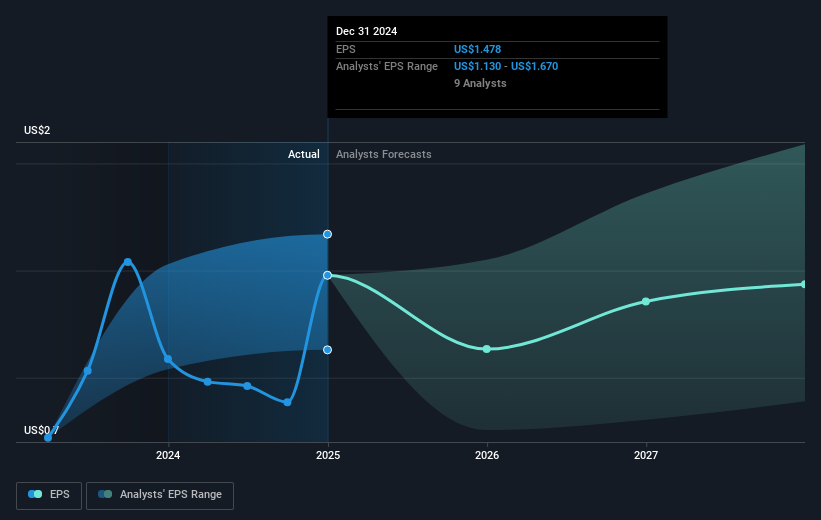

In relation to revenue and earnings forecasts, the emphasis on hybrid trucks and recurring services, combined with cost reduction initiatives, might drive long-term financial growth. However, potential pricing pressures and global trade policy uncertainties could pose risks to these projections. In terms of Ford's current share price of US$8.69, it remains 16.8% below the consensus analyst price target of US$10.45, suggesting a potential upside if anticipated conditions materialize.

Click to explore a detailed breakdown of our findings in Ford Motor's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal