American Express (NYSE:AXP) Maintains 2025 Revenue Guidance, Reports Q1 Earnings Growth

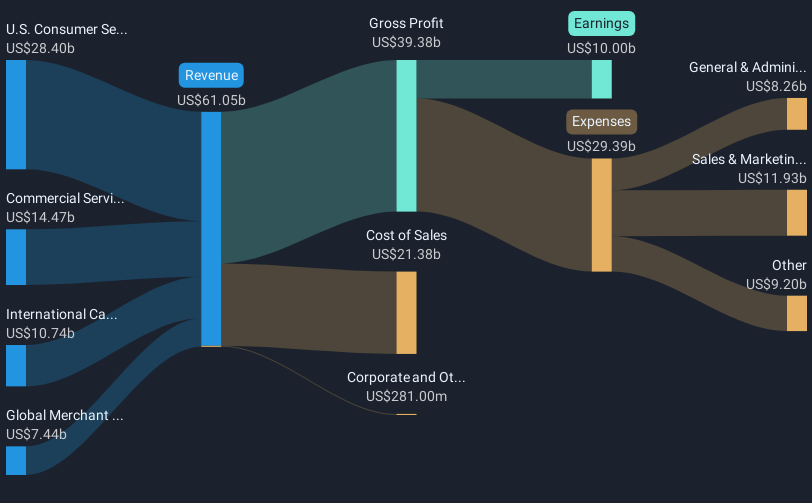

American Express (NYSE:AXP) recently reported its first-quarter earnings for 2025, showing an increase in net income and earnings per share compared to the previous year, with the company maintaining its optimistic full-year guidance. Over the past week, American Express's stock price rose by 1.79%, mirroring positive sentiment despite a market that remained flat. The company's solid financial results and affirmations of revenue and EPS growth targets likely added weight to this upward movement, aligning with a broader market trend over the past year where stocks have gained 5.7%.

The recent earnings report from American Express, indicating growth in both net income and earnings per share, suggests positive momentum that could sustain investor interest. However, potential headwinds such as increased investment demands and credit concerns, combined with a need to outpace competitors, may impact future revenue and earnings forecasts. The company's strategy to focus on premium products and international growth projects a path to sustained revenue growth but remains contingent on economic factors and competitive pressures.

Over the past five years, American Express shares delivered a total return of 225.37%, highlighting significant longer-term shareholder value creation. This performance exceeds the market return of 5.7% and the Consumer Finance industry return of 14% over the past year, illustrating the company's robust trajectory in a competitive environment. Investors will monitor how American Express manages its market position as this level of performance contrasts with its forecasted earnings growth of 8.9% per year, which may lag the broader US market growth expectations.

The news potentially underscores stable revenue forecasts, aligning with an analyst consensus fair value that places the price target at US$293.88, approximately 17% above the current share price of US$262.36. This suggests room for appreciation, yet some analysts express caution with a bearish target of US$254.6, reflecting concerns. Overall, while the current share price stands close to analyst targets, it remains pivotal for new growth catalysts to support sustained bullish sentiment among investors.

Review our growth performance report to gain insights into American Express' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal