Netflix (NasdaqGS:NFLX) Reaffirms 2025 Revenue Guidance And Announces Leadership Transition

Netflix (NasdaqGS:NFLX) reaffirmed its earnings guidance for 2025 and provided an optimistic outlook on revenue growth, while announcing significant leadership changes with Reed Hastings transitioning to Chairman of the Board. Although the overall market remained flat, Netflix's share price saw a 13.39% increase over the last quarter. This performance aligns with broader market movements, which showed a 5.7% annual gain, and includes the company's strong historical earnings and future revenue guidance. Events such as executive shifts and the strategic cancellation of a game project added weight to these gains, enhancing investor confidence amid steady market conditions.

Netflix has 1 risk we think you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

The recent leadership transition at Netflix, along with reaffirmed earnings guidance and optimistic revenue projections, could bolster investor confidence, potentially driving further share price appreciation. This optimism complements Netflix's strategic investments in global content, ad technology, and expanded entertainment offerings, which are expected to boost audience engagement and, consequently, revenue growth. However, challenges such as currency fluctuations and increased content spending present future risks that require careful management to maintain projected growth rates.

Over a three-year span, Netflix's total shareholder return, including share price performance and dividends, reached 345.89%. This impressive return underscores the company's capacity to outperform broader market movements, as demonstrated by its one-year return which surpassed the US market's 5.7% annual gain and the entertainment industry's 31.9% return. This context highlights Netflix's resilience and market strength, although risks in maintaining such growth persist.

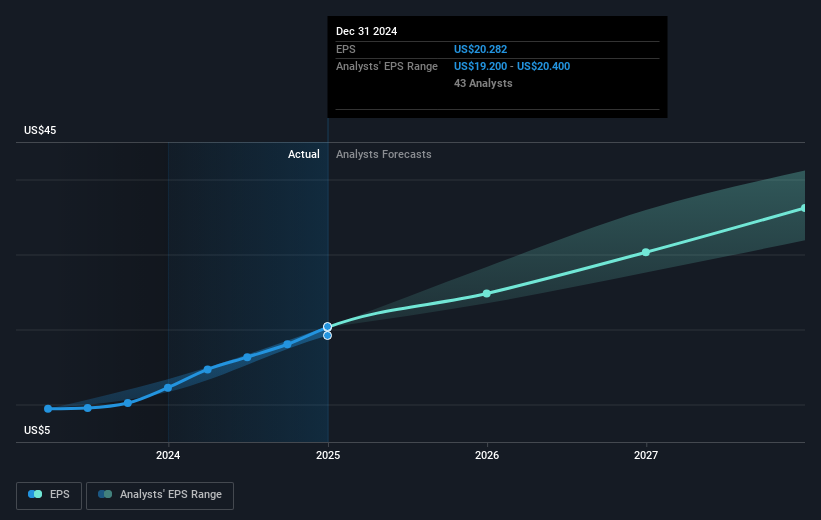

The revised revenue and earnings forecasts, bolstered by strategic development in advertising and content, suggest potential growth in revenues to US$54.9 billion by 2028 with earnings anticipated to hit US$15.2 billion. Nonetheless, reaching consensus analyst price targets of US$1065.05, 9.7% above the current share price of US$961.63, will depend on continued execution, including a transition in trading multiple from a PE ratio of 47.2x to 37.3x. Investors should consider these dynamics in light of ongoing market conditions and company performance metrics.

Upon reviewing our latest valuation report, Netflix's share price might be too optimistic.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal