April 2025's Promising Penny Stocks

Over the last 7 days, the market has remained flat, but it is up 5.7% over the past year, with earnings forecast to grow by 13% annually. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still present significant opportunities when backed by solid financials. We've selected three examples of penny stocks that combine balance sheet strength with potential for outsized gains, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.30 | $347.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $1.95 | $1.16B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $0.9144 | $15.82M | ✅ 4 ⚠️ 4 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.78 | $48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.50 | $317.75M | ✅ 5 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.46 | $72.8M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (OTCPK:BABB) | $0.81 | $5.96M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $199.34M | ✅ 3 ⚠️ 2 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.81 | $84.44M | ✅ 3 ⚠️ 2 View Analysis > |

| New Horizon Aircraft (NasdaqCM:HOVR) | $0.4476 | $13.9M | ✅ 3 ⚠️ 5 View Analysis > |

Click here to see the full list of 783 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Kodiak Sciences (NasdaqGM:KOD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kodiak Sciences Inc. is a clinical stage biopharmaceutical company focused on the research, development, and commercialization of therapeutics for retinal diseases, with a market cap of approximately $124.20 million.

Operations: Kodiak Sciences Inc. does not report any revenue segments as it is currently in the clinical stage of developing therapeutics for retinal diseases.

Market Cap: $124.2M

Kodiak Sciences Inc., a clinical-stage biopharmaceutical company, is pre-revenue and focuses on developing therapeutics for retinal diseases. Despite having no debt and short-term assets exceeding liabilities, the company faces challenges with a cash runway of less than a year if free cash flow continues to decline. Recent earnings show reduced losses compared to the previous year, yet auditors express concern over its ability to continue as a going concern. The company's advanced clinical trials for tarcocimab tedromer offer potential but carry inherent risks common in biotech development stages. Its stock price remains highly volatile amidst these uncertainties.

- Take a closer look at Kodiak Sciences' potential here in our financial health report.

- Gain insights into Kodiak Sciences' outlook and expected performance with our report on the company's earnings estimates.

Design Therapeutics (NasdaqGS:DSGN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Design Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on researching, designing, developing, and commercializing small molecule therapeutic drugs for genetic diseases in the United States with a market cap of approximately $191.86 million.

Operations: Design Therapeutics, Inc. currently does not report any revenue segments.

Market Cap: $191.86M

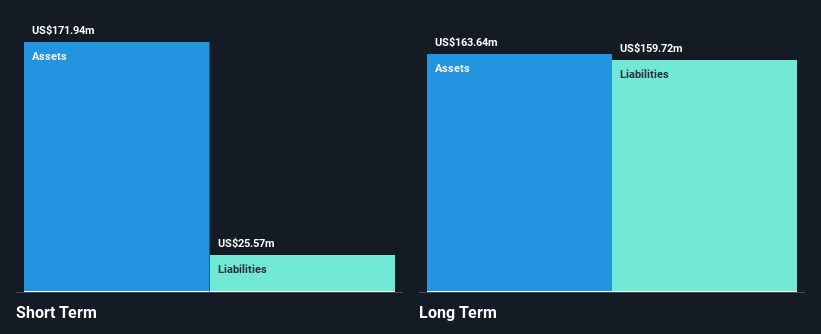

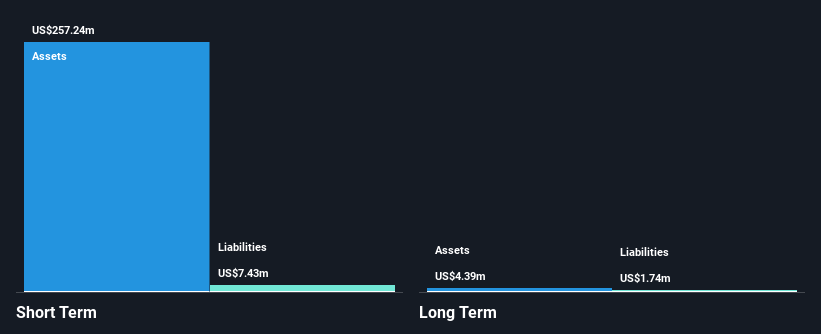

Design Therapeutics, Inc., a pre-revenue clinical-stage biopharmaceutical company, maintains a strong financial position with no debt and short-term assets of US$248 million exceeding liabilities. Despite its unprofitability and forecasted decline in earnings over the next three years, the company has sufficient cash runway for more than three years. Recent leadership changes with the appointment of Dr. Chris M. Storgard as Chief Medical Officer could enhance its drug development capabilities. The stock remains highly volatile, reflecting both potential opportunities in ongoing trials and inherent risks typical of early-stage biotech ventures.

- Dive into the specifics of Design Therapeutics here with our thorough balance sheet health report.

- Gain insights into Design Therapeutics' future direction by reviewing our growth report.

Qudian (NYSE:QD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qudian Inc. is a consumer-oriented technology company based in the People’s Republic of China with a market cap of approximately $465.93 million.

Operations: The company's revenue is primarily derived from its Installment Credit Services, amounting to CN¥227.99 million.

Market Cap: $465.93M

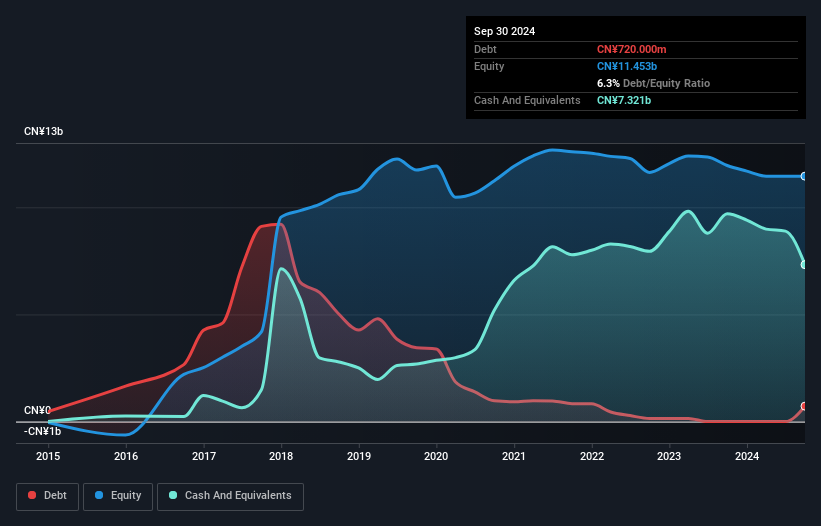

Qudian Inc., a consumer-oriented technology company, recently reported a net loss of CN¥66.36 million for Q4 2024, reflecting ongoing challenges in profitability despite reduced debt levels and strong short-term asset coverage. The company's earnings have declined significantly over the past five years, with negative growth making it difficult to compare to industry averages. However, Qudian has completed a share buyback program worth $41.2 million and maintains more cash than total debt, highlighting financial stability amidst volatility. Recent auditor changes could impact investor confidence but do not stem from disagreements on accounting practices.

- Click here to discover the nuances of Qudian with our detailed analytical financial health report.

- Understand Qudian's track record by examining our performance history report.

Next Steps

- Discover the full array of 783 US Penny Stocks right here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal