The Price Is Right For Barfresh Food Group, Inc. (NASDAQ:BRFH) Even After Diving 34%

Barfresh Food Group, Inc. (NASDAQ:BRFH) shareholders won't be pleased to see that the share price has had a very rough month, dropping 34% and undoing the prior period's positive performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 133% in the last twelve months.

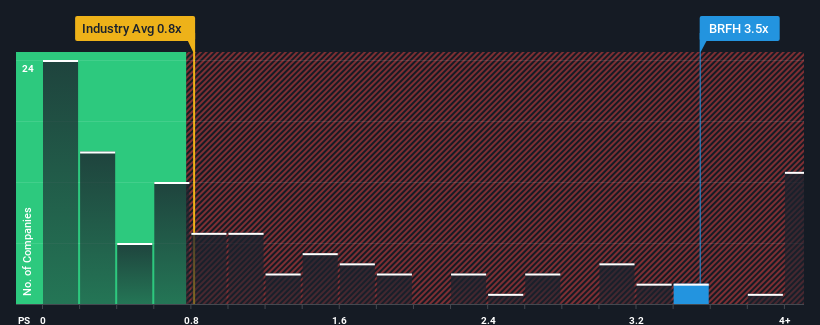

In spite of the heavy fall in price, you could still be forgiven for thinking Barfresh Food Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.5x, considering almost half the companies in the United States' Food industry have P/S ratios below 0.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 2 warning signs investors should be aware of before investing in Barfresh Food Group. Read for free now.Check out our latest analysis for Barfresh Food Group

How Has Barfresh Food Group Performed Recently?

Barfresh Food Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Barfresh Food Group will help you uncover what's on the horizon.How Is Barfresh Food Group's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Barfresh Food Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 32% gain to the company's top line. Pleasingly, revenue has also lifted 60% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 38% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 1.5%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Barfresh Food Group's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Barfresh Food Group's shares may have suffered, but its P/S remains high. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Barfresh Food Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Food industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Barfresh Food Group, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal