DigitalBridge Group's (NYSE:DBRG) earnings have declined over three years, contributing to shareholders 72% loss

Every investor on earth makes bad calls sometimes. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of DigitalBridge Group, Inc. (NYSE:DBRG), who have seen the share price tank a massive 72% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The more recent news is of little comfort, with the share price down 54% in a year. The falls have accelerated recently, with the share price down 30% in the last three months. But this could be related to the weak market, which is down 13% in the same period.

While the stock has risen 8.0% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

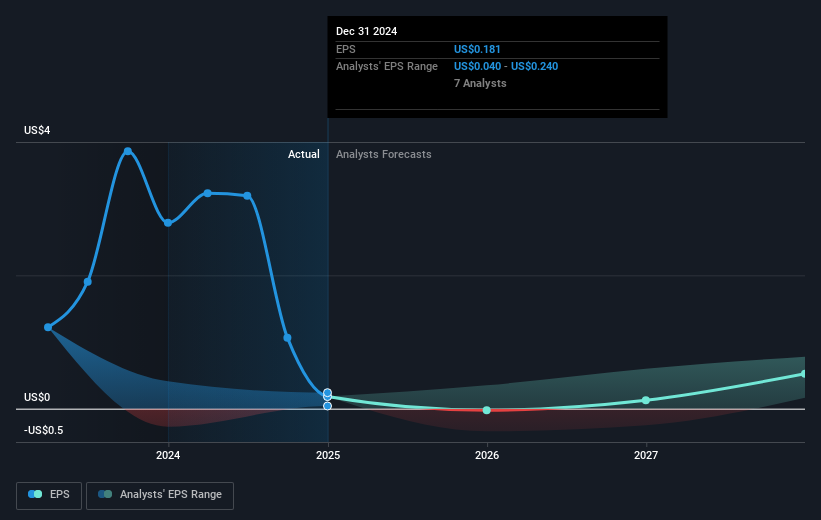

During the three years that the share price fell, DigitalBridge Group's earnings per share (EPS) dropped by 62% each year. In comparison the 35% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines. This positive sentiment is also reflected in the generous P/E ratio of 45.38.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on DigitalBridge Group's earnings, revenue and cash flow.

A Different Perspective

Investors in DigitalBridge Group had a tough year, with a total loss of 54% (including dividends), against a market gain of about 7.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 0.9%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for DigitalBridge Group you should know about.

Of course DigitalBridge Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal