Assessing Thermo Fisher Scientific: Insights From 9 Financial Analysts

Thermo Fisher Scientific (NYSE:TMO) has been analyzed by 9 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 4 | 4 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 3 | 2 | 0 | 0 |

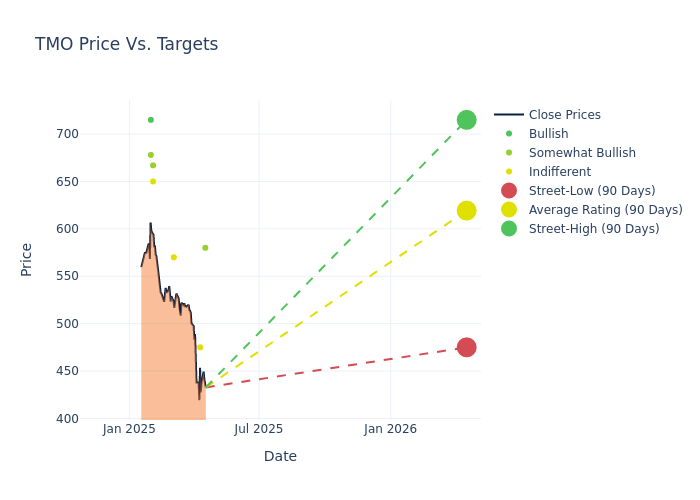

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $629.44, with a high estimate of $715.00 and a low estimate of $475.00. Experiencing a 2.53% decline, the current average is now lower than the previous average price target of $645.78.

Decoding Analyst Ratings: A Detailed Look

The perception of Thermo Fisher Scientific by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Brandon Couillard |Wells Fargo |Lowers |Overweight | $580.00|$680.00 | |Luke Sergott |Barclays |Lowers |Equal-Weight | $475.00|$620.00 | |Patrick Donnelly |Citigroup |Lowers |Neutral | $570.00|$650.00 | |Sung Ji Nam |Scotiabank |Raises |Sector Perform | $650.00|$605.00 | |Andrew Cooper |Raymond James |Raises |Outperform | $667.00|$650.00 | |Patrick Donnelly |Citigroup |Raises |Neutral | $650.00|$600.00 | |Dan Leonard |UBS |Raises |Buy | $715.00|$700.00 | |Brandon Couillard |Wells Fargo |Raises |Overweight | $680.00|$660.00 | |Tejas Savant |Morgan Stanley |Raises |Overweight | $678.00|$647.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Thermo Fisher Scientific. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Thermo Fisher Scientific compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Thermo Fisher Scientific's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Thermo Fisher Scientific's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Thermo Fisher Scientific analyst ratings.

All You Need to Know About Thermo Fisher Scientific

Thermo Fisher Scientific sells scientific instruments and laboratory equipment, diagnostics consumables, and life science reagents. The firm operates through four segments as of year end-2024 (revenue figures include some cross-segment revenue): analytical technologies (17% of sales); specialty diagnostic products (11%); life science solutions (23%); and lab products and services, which includes CRO services (54%).

Understanding the Numbers: Thermo Fisher Scientific's Finances

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Over the 3M period, Thermo Fisher Scientific showcased positive performance, achieving a revenue growth rate of 4.68% as of 31 December, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: Thermo Fisher Scientific's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 16.06% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.71%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Thermo Fisher Scientific's ROA stands out, surpassing industry averages. With an impressive ROA of 1.85%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Thermo Fisher Scientific's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.63.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal