Prologis (NYSE:PLD) Reports Q1 Revenue Growth To US$2,140 Million

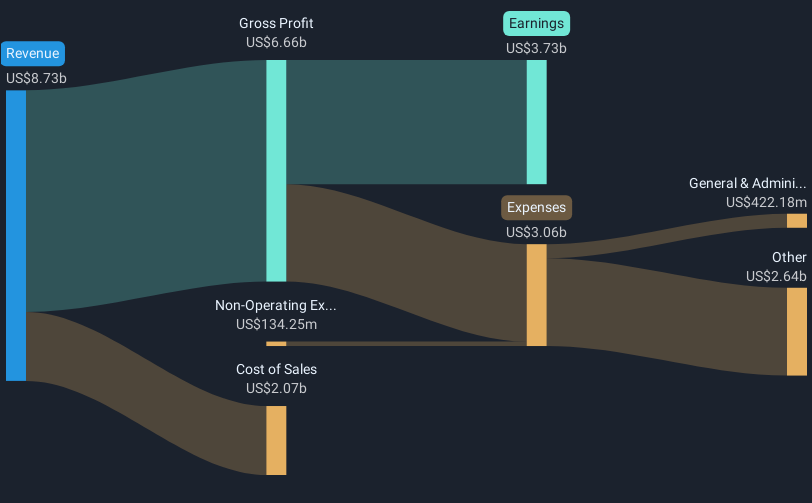

Prologis (NYSE:PLD) reported strong first-quarter results for 2025, with sales and revenue substantially increasing compared to the previous year, and a slight uptick in net income. Over the last week, Prologis's stock rose 2.11%, counteracting the broader market decline of 3.0%. The company's consistent earnings, in the face of wider market volatility driven by tech sector challenges and tariffs, highlight its steady performance. While the Dow Jones lost ground due to specific health sector setbacks, Prologis managed to sustain investor confidence through its solid financial results, demonstrating robust resilience amidst market fluctuations.

The strong first-quarter results reported by Prologis, with notable rises in both sales and revenue, have positioned the company favorably against recent market turbulence. As the stock rose 2.11% over the past week amid a broader market decline, this resilience may encourage positive sentiment towards Prologis's long-term potential, especially given the challenging landscape in the tech sector and ongoing tariff issues. However, the company's ambitious data center investments could exert pressure on margins and returns if yields become more volatile. This expansion, while growth-oriented, might impact earnings forecasts if the expected capital recycling does not proceed as efficiently as projected.

For the last five years until today, Prologis's total shareholder return, including dividends, was 30.18%. This performance illustrates a solid growth trajectory. In comparison, over the past year, Prologis has exceeded returns within the US Industrial REITs industry, which experienced a 7.8% decline. The share price of US$119.91 closely aligns with the analyst price target consensus of US$129.65, suggesting a modest 7.5% potential upside based on current valuations.

The company's shifting focus toward data centers and international markets introduces variables that could affect revenue and earnings growth assumptions projected to shrink over the next three years. Analysts' projections of a 4.2% annual revenue growth and a decline in profit margins suggest cautious optimism. With current forecasts placing Prologis's 2028 revenue at an estimated US$9.70 billion, achieving these targets amid geopolitical and market uncertainties remains a complex endeavor. The small share price discount to price target, standing at approximately 21.95%, indicates a belief that the stock is fairly priced relative to its future potential, emphasizing the need for careful evaluation of Prologis’s financial strategies and market conditions.

Dive into the specifics of Prologis here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal