Charles Schwab (NYSE:SCHW) Reports Q1 Net Income of US$1,909 Million and Earnings Growth

Charles Schwab (NYSE:SCHW) recently reported strong first-quarter earnings, with substantial increases in both net income and earnings per share. Despite the broader market's 3% decline, Schwab's stock remained flat over the last week, showing resilience in a tumultuous market environment. This performance comes amid mixed movements in key indexes, such as the S&P 500's slight gain and the Dow's fall. Schwab's introduction of its Alternative Investments Platform for high net worth clients likely provided support against the negative pressures in the market, which was influenced by factors such as tariff concerns and fluctuations in major tech stocks.

You should learn about the 1 risk we've spotted with Charles Schwab.

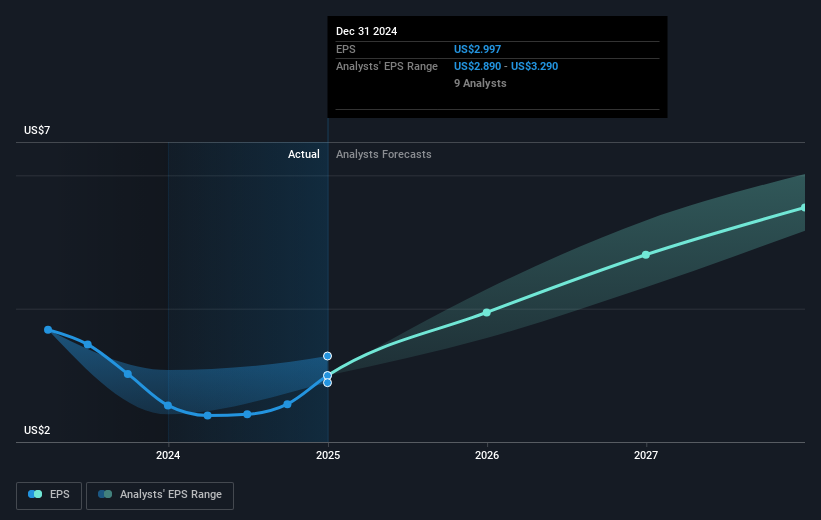

The recent introduction of Charles Schwab's Alternative Investments Platform aligns with its strategic goals of expanding client solutions and optimizing operational efficiencies. This move might enhance revenue and net margins, especially as AI integrations and banking service expansions are poised to improve client relationships and streamline processes. With the Ameritrade acquisition providing potential uplift through cross-selling opportunities and client base expansion, these developments are likely echoed in revenue forecasts, which analysts project to grow at 11.1% annually. While Schwab's quarterly earnings have shown resilience by remaining flat despite broader market pressures, the long-term total shareholder return of 126.52% over five years highlights the company's growth trajectory.

In terms of market performance, over the past year, Schwab's return matched the US market, contrasting its underperformance against the US Capital Markets industry. This position may change as the integration of Ameritrade concludes and AI-driven efficiencies materialize. Considering the current share price of $69.93, the analyst consensus suggests a price target of $87.35, indicating a potential upside. However, it's worth noting the variance in analyst expectations, with targets ranging from $65.00 to $103.00. The share price’s steadiness amidst market declines underscores its potential stability, yet its future trajectory relies heavily on how effectively the Ameritrade integration and AI advancements enhance revenue and earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal