Intuitive Surgical (NasdaqGS:ISRG): New Studies Highlight Robotic Surgery's Role In Expanding Patient Access

Intuitive Surgical (NasdaqGS:ISRG) recently published studies highlighting the benefits of Robotic-Assisted Surgery (RAS), but its stock price saw a modest decline of 1.53% over the past month. During this period, the company also secured FDA clearance for a new surgical stapler, which could play a part in enhancing minimally invasive surgeries. Despite these significant announcements, the slight downward price movement aligns broadly with market trends observed in major indexes like the Dow, which are dealing with broader economic concerns such as tariff implications. Thus, while these developments underscore Intuitive's ongoing innovations, they were in tune with general market dynamics.

Find companies with promising cash flow potential yet trading below their fair value.

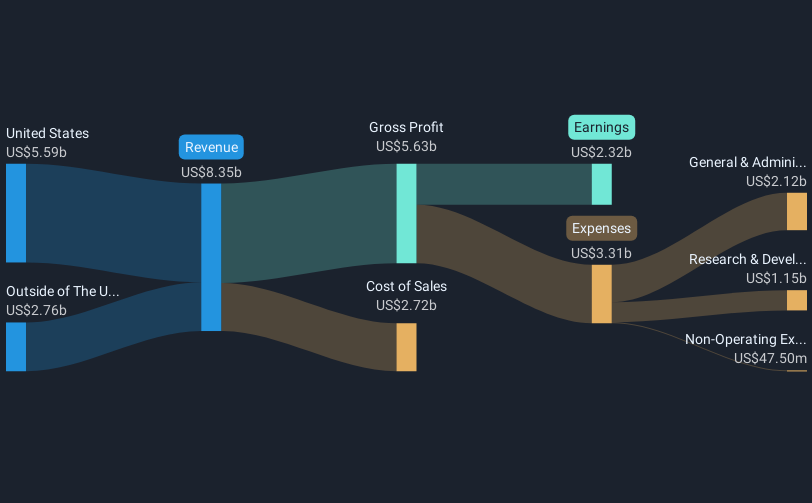

Intuitive Surgical's recent announcements, such as the FDA clearance for a new surgical stapler and studies on Robotic-Assisted Surgery, have the potential to bolster its long-term revenue and earnings outlook. The introduction of these innovations supports the narrative around the company’s focus on expanding its da Vinci platform and optimizing manufacturing processes, which may enhance operating efficiencies and market penetration. While the short-term share price declined by 1.53%, this movement is reflective of wider market trends, including tariff-related economic pressures. However, over the past five years, Intuitive Surgical's total return, inclusive of dividends and share price appreciation, has been substantial at 181.96%.

Comparatively, Intuitive Surgical has outperformed the US Medical Equipment industry in the last year, with a return that surpassed the industry's 3.2% gain. The news of regulatory clearances and product expansion could positively influence analysts' forecasts, projecting revenue and earnings growth over the next few years. The consensus price target for the company currently stands at US$619.74, representing a 26.2% premium over the recent share price of US$457.63. If these anticipated growth catalysts materialize, shareholder returns could align more closely with analysts’ bullish outlook. Nonetheless, investors should consider these predictions within the broader context of market dynamics and individual assumptions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal