Alignment Healthcare And 2 Other Stocks That Might Be Priced Below Their Fair Value

As the U.S. stock market navigates a period of heightened volatility, with mixed performances across major indices and concerns about tariffs and economic growth, investors are keenly evaluating opportunities for value amidst the turmoil. In such an environment, identifying stocks that may be priced below their fair value can offer potential for long-term gains, making it crucial to focus on companies with strong fundamentals and resilience in challenging conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $39.58 | $78.07 | 49.3% |

| First National (NasdaqCM:FXNC) | $18.60 | $36.87 | 49.6% |

| First Bancorp (NasdaqGS:FBNC) | $36.82 | $72.67 | 49.3% |

| Datadog (NasdaqGS:DDOG) | $91.88 | $178.65 | 48.6% |

| DoorDash (NasdaqGS:DASH) | $179.39 | $350.88 | 48.9% |

| Sotera Health (NasdaqGS:SHC) | $10.49 | $20.95 | 49.9% |

| BioLife Solutions (NasdaqCM:BLFS) | $22.26 | $44.39 | 49.9% |

| First Advantage (NasdaqGS:FA) | $13.79 | $27.43 | 49.7% |

| MYT Netherlands Parent B.V (NYSE:MYTE) | $7.81 | $15.29 | 48.9% |

| CNX Resources (NYSE:CNX) | $30.88 | $60.85 | 49.3% |

Let's dive into some prime choices out of the screener.

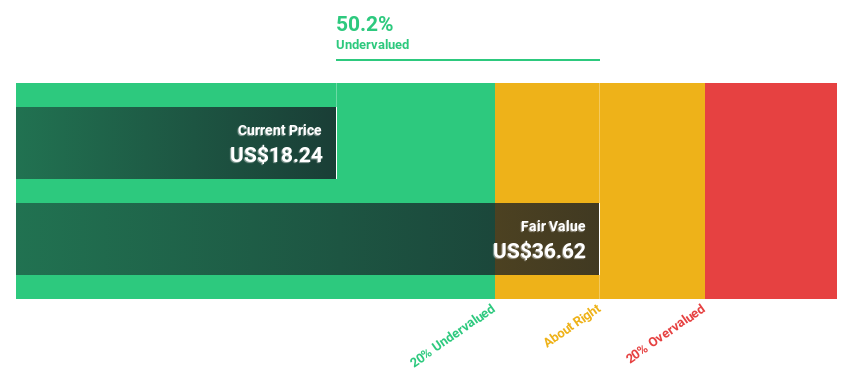

Alignment Healthcare (NasdaqGS:ALHC)

Overview: Alignment Healthcare, Inc. operates a consumer-centric healthcare platform for seniors in the United States and has a market cap of approximately $3.73 billion.

Operations: The company's revenue is primarily derived from providing healthcare services, totaling approximately $2.70 billion.

Estimated Discount To Fair Value: 46.8%

Alignment Healthcare, trading at US$19.48, is significantly undervalued compared to its estimated fair value of US$36.62, presenting a potential opportunity for investors focused on cash flow valuation. Despite recent insider selling and low forecasted return on equity (6.6%), the company's revenue growth projections (20.5% annually) outpace the market average. Recent leadership changes aim to enhance care delivery through technology integration, potentially supporting future profitability as it aims for positive earnings within three years.

- According our earnings growth report, there's an indication that Alignment Healthcare might be ready to expand.

- Unlock comprehensive insights into our analysis of Alignment Healthcare stock in this financial health report.

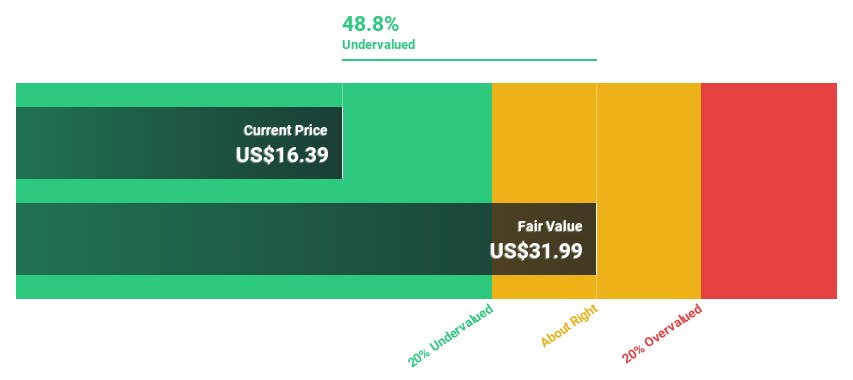

CNX Resources (NYSE:CNX)

Overview: CNX Resources Corporation is an independent natural gas and midstream company focused on acquiring, exploring, developing, and producing natural gas properties in the Appalachian Basin with a market capitalization of approximately $4.54 billion.

Operations: The company's revenue segments include Shale, generating $1.15 billion, and Coalbed Methane, contributing $105.12 million.

Estimated Discount To Fair Value: 49.3%

CNX Resources, trading at US$30.88, is highly undervalued compared to its estimated fair value of US$60.85, offering potential for cash flow-focused investors. Despite a net loss of US$90.49 million in 2024 and interest payments not well covered by earnings, the company anticipates becoming profitable within three years with revenue growth (19.6% annually) surpassing the market average. Recent debt financing supports strategic acquisitions aimed at enhancing future profitability and operational scale.

- The analysis detailed in our CNX Resources growth report hints at robust future financial performance.

- Dive into the specifics of CNX Resources here with our thorough financial health report.

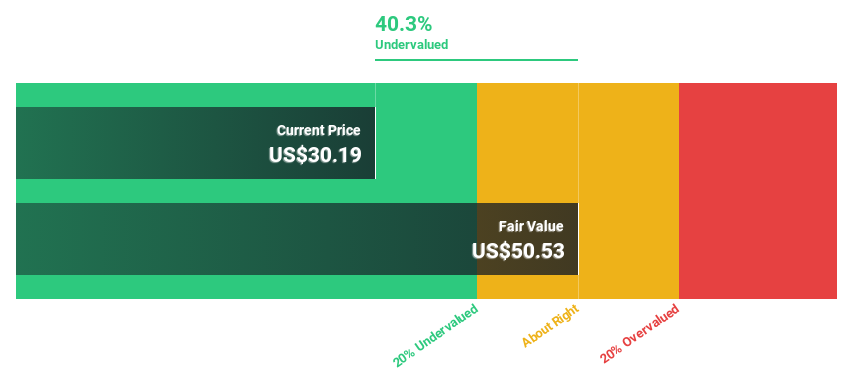

Grindr (NYSE:GRND)

Overview: Grindr Inc. operates a social networking and dating application for the LGBTQ communities worldwide, with a market cap of approximately $3.93 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, which amounts to $344.64 million.

Estimated Discount To Fair Value: 40.6%

Grindr, currently trading at US$18.92, is significantly undervalued relative to its estimated fair value of US$31.85, presenting an opportunity for investors focused on cash flows. Despite a net loss of US$131 million in 2024 and past shareholder dilution, the company forecasts robust revenue growth at 17.4% annually and aims to achieve profitability within three years. The recent expansion of their Right Now feature across major cities could enhance user engagement and future revenue streams.

- Upon reviewing our latest growth report, Grindr's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Grindr's balance sheet health report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 171 Undervalued US Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal