6 Analysts Have This To Say About Jabil

Analysts' ratings for Jabil (NYSE:JBL) over the last quarter vary from bullish to bearish, as provided by 6 analysts.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

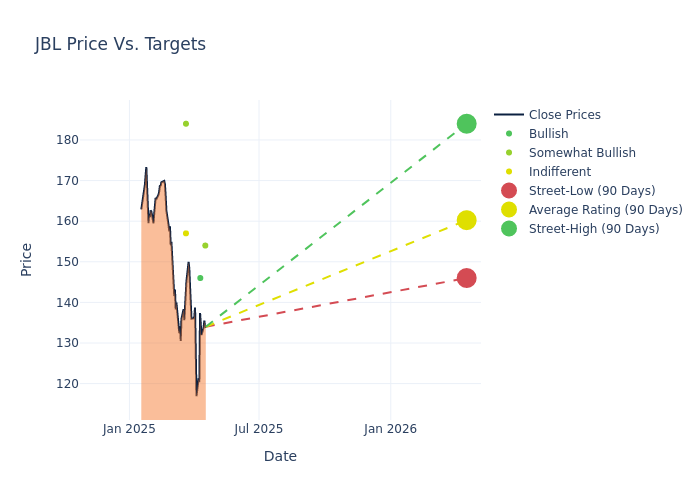

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $165.83, with a high estimate of $184.00 and a low estimate of $146.00. Highlighting a 1.78% decrease, the current average has fallen from the previous average price target of $168.83.

Understanding Analyst Ratings: A Comprehensive Breakdown

The analysis of recent analyst actions sheds light on the perception of Jabil by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Samik Chatterjee |JP Morgan |Lowers |Overweight | $154.00|$175.00 | |Mark Delaney |Goldman Sachs |Lowers |Buy | $146.00|$175.00 | |George Wang |Barclays |Raises |Overweight | $184.00|$179.00 | |Samik Chatterjee |JP Morgan |Raises |Overweight | $175.00|$172.00 | |David Vogt |UBS |Raises |Neutral | $157.00|$152.00 | |Mark Delaney |Goldman Sachs |Raises |Buy | $179.00|$160.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Jabil. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Jabil compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Jabil's stock. This analysis reveals shifts in analysts' expectations over time.

Capture valuable insights into Jabil's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Jabil analyst ratings.

About Jabil

Jabil Inc is a United States-based company engaged in providing manufacturing services and solutions. It provides comprehensive electronics design, production and product management services to companies in various industries and end markets.The Company derives its revenue from providing comprehensive electronics design, production and product management services. It operates in two segments. The Electronics Manufacturing Services (EMS) segment, which is the key revenue driver, is focused on leveraging IT, supply chain design and engineering, technologies largely centered on core electronics. The Diversified Manufacturing Services (DMS) segment is focused on providing engineering solutions, with an emphasis on material sciences, technologies, and healthcare.

Jabil: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Decline in Revenue: Over the 3M period, Jabil faced challenges, resulting in a decline of approximately -0.58% in revenue growth as of 28 February, 2025. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 1.74%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Jabil's ROE stands out, surpassing industry averages. With an impressive ROE of 7.93%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Jabil's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.67% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Jabil's debt-to-equity ratio stands notably higher than the industry average, reaching 2.42. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal