Is United Natural Foods (NYSE:UNFI) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, United Natural Foods, Inc. (NYSE:UNFI) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

How Much Debt Does United Natural Foods Carry?

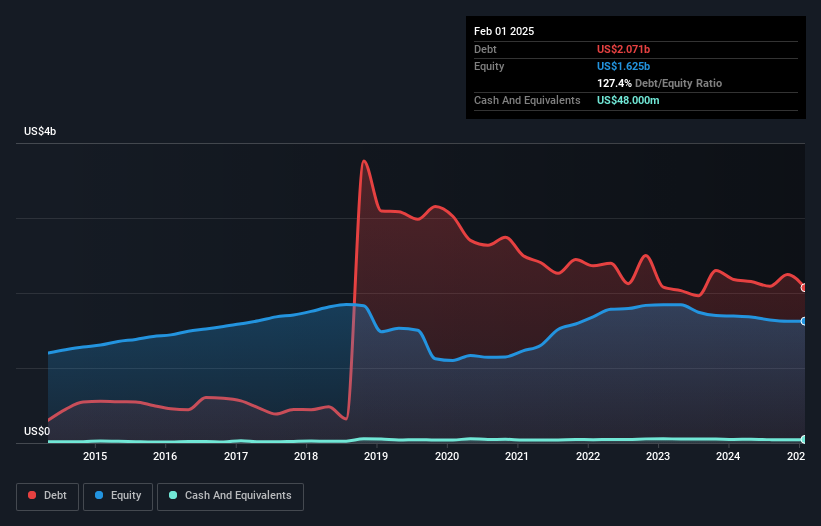

You can click the graphic below for the historical numbers, but it shows that United Natural Foods had US$2.07b of debt in February 2025, down from US$2.18b, one year before. However, it also had US$48.0m in cash, and so its net debt is US$2.02b.

How Healthy Is United Natural Foods' Balance Sheet?

We can see from the most recent balance sheet that United Natural Foods had liabilities of US$2.39b falling due within a year, and liabilities of US$3.71b due beyond that. Offsetting these obligations, it had cash of US$48.0m as well as receivables valued at US$1.03b due within 12 months. So it has liabilities totalling US$5.03b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the US$1.46b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, United Natural Foods would likely require a major re-capitalisation if it had to pay its creditors today.

Check out our latest analysis for United Natural Foods

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While United Natural Foods's debt to EBITDA ratio (4.0) suggests that it uses some debt, its interest cover is very weak, at 1.2, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. The silver lining is that United Natural Foods grew its EBIT by 128% last year, which nourishing like the idealism of youth. If it can keep walking that path it will be in a position to shed its debt with relative ease. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if United Natural Foods can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, United Natural Foods produced sturdy free cash flow equating to 68% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

To be frank both United Natural Foods's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Once we consider all the factors above, together, it seems to us that United Natural Foods's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for United Natural Foods you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal