8 Analysts Assess Allison Transmission: What You Need To Know

Throughout the last three months, 8 analysts have evaluated Allison Transmission (NYSE:ALSN), offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 7 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 5 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

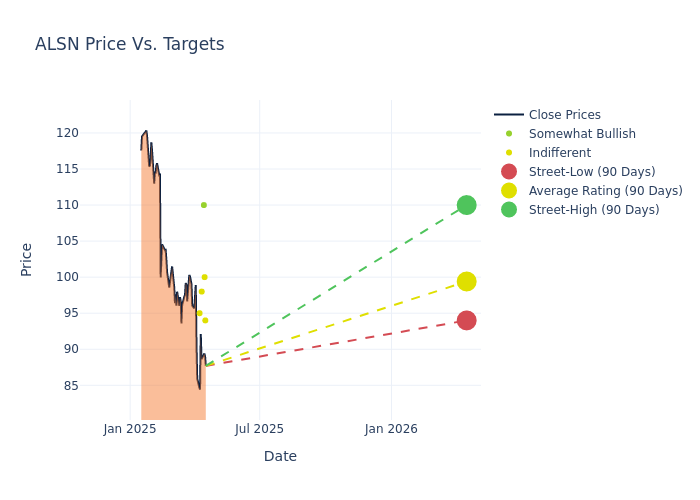

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $103.75, a high estimate of $115.00, and a low estimate of $94.00. This current average represents a 10.94% decrease from the previous average price target of $116.50.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Allison Transmission is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Angel Castillo |Morgan Stanley |Lowers |Equal-Weight | $94.00|$112.00 | |Luke Junk |Baird |Lowers |Neutral | $100.00|$123.00 | |Tim Thein |Raymond James |Lowers |Outperform | $110.00|$115.00 | |Tami Zakaria |JP Morgan |Lowers |Neutral | $98.00|$110.00 | |Kyle Menges |Citigroup |Lowers |Neutral | $95.00|$108.00 | |Kyle Menges |Citigroup |Lowers |Neutral | $108.00|$115.00 | |Tami Zakaria |JP Morgan |Lowers |Neutral | $110.00|$129.00 | |Kyle Menges |Citigroup |Lowers |Neutral | $115.00|$120.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Allison Transmission. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Allison Transmission compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Allison Transmission's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Allison Transmission's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Allison Transmission analyst ratings.

Discovering Allison Transmission: A Closer Look

Allison Transmission is the largest manufacturer of fully automatic transmissions for commercial vehicles. The company's automatic transmissions allow customers to achieve better fuel and operator efficiency than less expensive manual and automated manual transmissions. Allison serves several end markets, including on- and off-highway equipment and military vehicles. Its on-highway business has about 60% global market share. The company's transmissions can be found in Class 4-8 trucks, buses, and a limited number of large passenger vehicles (heavy-duty pickup trucks and motor homes). Allison also produces electric hybrid propulsion systems and is developing e-powertrains.

Allison Transmission: Delving into Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Allison Transmission's remarkable performance in 3M is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 2.71%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Allison Transmission's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 21.98% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Allison Transmission's ROE stands out, surpassing industry averages. With an impressive ROE of 10.7%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Allison Transmission's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.27% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Allison Transmission's debt-to-equity ratio stands notably higher than the industry average, reaching 1.46. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Understanding the Relevance of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal