Garmin (NYSE:GRMN) Sees 11% Stock Surge This Week

Garmin (NYSE:GRMN) made significant strides last week with notable product launches such as the Varia™ Vue headlight camera and the vívoactive® 6 smartwatch. This continuous innovation, coupled with collaborations like integrating Garmin's technology in space research, underscores the company's robust product development strategy. These developments likely contributed to Garmin's share price increase of 10.76% over the week. Meanwhile, the broader market also saw an uptrend of 8.4%, fuelled by gains across various sectors, despite uncertainties like U.S. restrictions on chip exports to China affecting tech stocks. This alignment suggests Garmin's moves added weight to the broader market trends.

Every company has risks, and we've spotted 1 weakness for Garmin you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent product launches by Garmin, highlighted in the introduction, could play a significant role in expanding their portfolio across several key segments—fitness, outdoor, marine, and aviation. This diversification is aligned with the anticipated revenue and earnings growth outlined in the company's narrative. With a strong focus on innovation, the potential uplift in revenue streams might support Garmin’s navigation through competitive and macroeconomic challenges. Product advancements like the Varia™ Vue headlight camera and the vívoactive® 6 smartwatch could also drive consumer interest and sales, although increased R&D investments may impact margins in the short term.

Over a five-year period, Garmin's shareholders enjoyed a total return of 176.12%, signaling robust performance and resilience in various market conditions. This contrasts with their impressive one-year return where Garmin outperformed the US Consumer Durables industry despite macroeconomic hurdles. Such figures offer a deeper context to their current 10.76% weekly share price rise, driven by recent developments.

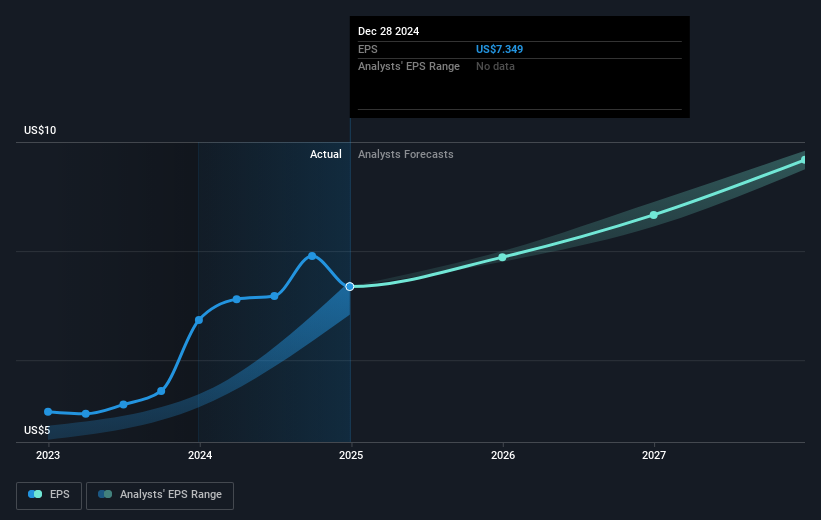

Despite the positive share price movement, Garmin's current trading price of US$173.63 remains below the analysts' consensus price target of US$206.94, indicating potential room for growth if future earnings and revenue forecasts are met. The company aims for revenue growth through new product lines and expanded market presence, with earnings expected to climb significantly in the coming years. While the current outlook is promising, it involves assumptions about competitive positioning and economic factors that can influence Garmin’s trajectory.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal