M&T Bank (NYSE:MTB) Declares US$0.35 And US$187.50 Preferred Stock Dividends

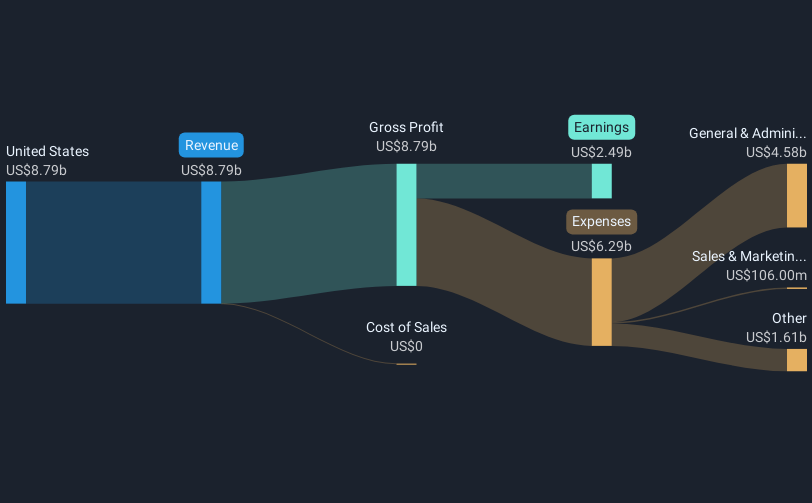

M&T Bank (NYSE:MTB) recently announced quarterly cash dividends for its preferred stockholders, marking an ongoing commitment to return value to shareholders. Over the past week, the company's share price moved up by 2%, likely influenced by the release of Q1 earnings results that showed an increase in net income and basic earnings per share compared to the previous year. Despite the widespread market volatility due to U.S. export restrictions affecting technology stocks, M&T Bank's solid financial performance and proactive dividend policy may have lent support to its modest share price gain against the broader market's upward trend.

Buy, Hold or Sell M&T Bank? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

M&T Bank's recent announcement of cash dividends for preferred stockholders underscores its dedication to shareholder value amid ongoing market volatility. Over the past five years, the company's total return, including dividends, reached 79.99%, illustrating a substantial gain relative to shorter-term fluctuations. Despite market challenges, the bank's long-term performance showcases resilience and growth potential.

In the past year, M&T Bank outperformed the US Banks industry, achieving higher returns than the industry's 11.7%. This positive discrepancy indicates robust financial management and strategic initiatives, gaining investor confidence. The bank's revenue strategies, such as its New England expansion and ESG practices, along with share repurchase plans, could bolster revenue and earnings forecasts. Currently, analysts project annual revenue growth of 5.9% over three years, with earnings likely rising to US$2.8 billion by 2028.

With a current share price of $156.58, M&T Bank trades at a 24% discount to the consensus analyst price target of $207.24. This discrepancy might reflect pessimistic views on large investment projects and potential risks, such as credit quality concerns. The bank's strategic growth initiatives, if executed effectively, could close the gap to the price target, enhancing shareholder value while driving further financial gains.

Review our growth performance report to gain insights into M&T Bank's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal