Applied Materials (NasdaqGS:AMAT) Shares Rise 13% in a Week Defying Tech Sell-Off

Applied Materials (NasdaqGS:AMAT) saw a notable price movement last week, with shares rising 13%. This comes as markets faced challenges, particularly in the semiconductor sector, due to U.S. export restrictions on chips to China impacting companies like Nvidia and AMD. Despite the broader tech sell-off, Applied Materials' shares bucked the trend, reflecting investor confidence amidst market turbulence. While the overall market increased by 8.4% over the same period, Applied Materials' performance stands out, partly countering broader market negative sentiment from geopolitical tensions and highlighting its resilience in the tech industry.

The recent rise in Applied Materials' shares by 13% against the backdrop of U.S. export restrictions provides an interesting dynamic for its long-term growth narrative. Over the past five years, the company's total shareholder return, including share price and dividends, reached a substantial 215.08%. This demonstrates resilience and an ability to capitalize on favorable market conditions. In contrast, during the past year, the company underperformed compared to the US semiconductor industry, which witnessed a 5.3% return, reflecting short-term pressures.

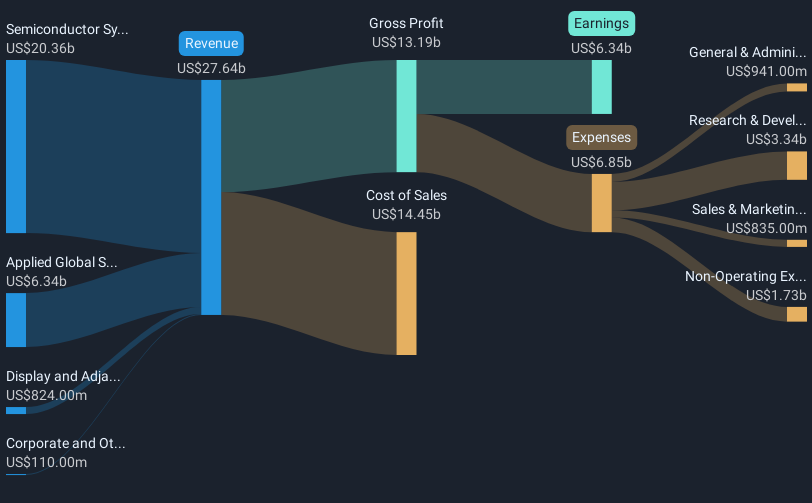

Applied Materials' advancements in AI and emerging technologies are enhancing its market position, potentially bolstering future revenue and earnings. However, trade restrictions could impact $400 million in revenue from China in fiscal 2025, presenting challenges. Analysts estimate revenues will grow by 6.2% annually, reaching US$33.1 billion by April 2028. Earnings are expected to increase, reaching US$8.9 billion, contingent on overcoming these barriers. With the current share price at US$128.96, the consensus price target of US$206.32 indicates a forecasted rise of about 37.5%, emphasizing analysts' optimism despite the geopolitical challenges impacting near-term growth.

Examine Applied Materials' earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal