Onto Innovation (NYSE:ONTO) Shares Surge 14% Last Week

Onto Innovation (NYSE:ONTO) experienced a significant share price movement last week with a 14% increase. This occurred despite Dr. Srinivas Vedula's resignation as Senior Vice President of Customer Success, which does not appear to have influenced the company's market performance directly. Instead, the broader market trends, such as an 8% rise in overall market activity, likely played a more substantial role in this upward price move. Wider sector gains and a positive market sentiment could have supported this performance, positioning Onto to outperform amid ongoing investor optimism.

You should learn about the 1 weakness we've spotted with Onto Innovation.

The recent 14% surge in Onto Innovation's (NYSE:ONTO) stock price amid the resignation of Dr. Srinivas Vedula highlights investor confidence driven by broader market trends rather than internal leadership changes. While short-term share price movements capture immediate market reactions, Onto Innovation's five-year total return of 289.87% underscores its substantial long-term growth. This performance over five years provides context for its recent share price fluctuations and positions the company favorably against the broader market dynamics over the past year, given that the US Semiconductor industry experienced a 5.3% return during the same period.

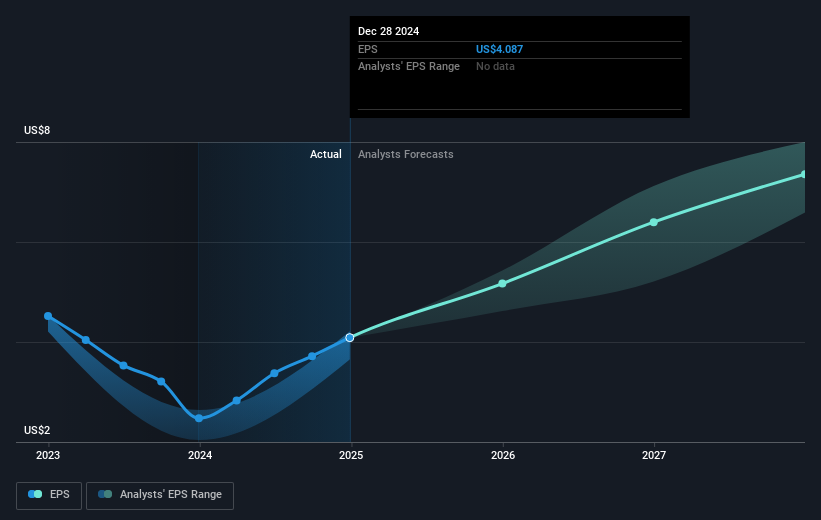

The news surrounding executive changes is unlikely to have a direct impact on Onto Innovation's projected revenue or earnings, considering the momentum in AI packaging and advanced metrology tools that are expected to drive future growth. Revenue projections supported by these industry trends are pivotal, with Onto Innovation's earnings forecasted to grow significantly. This aligns with the analysts' consensus price target of US$235.02, significantly higher than the current price of US$105.60, indicating potential market optimism subject to Onto meeting expected growth metrics. Investors should weigh these developments against their own projections and market conditions as the company navigates its growth pathways.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal