A Look Ahead: Forestar Group's Earnings Forecast

Forestar Group (NYSE:FOR) is preparing to release its quarterly earnings on Thursday, 2025-04-17. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Forestar Group to report an earnings per share (EPS) of $0.83.

Forestar Group bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

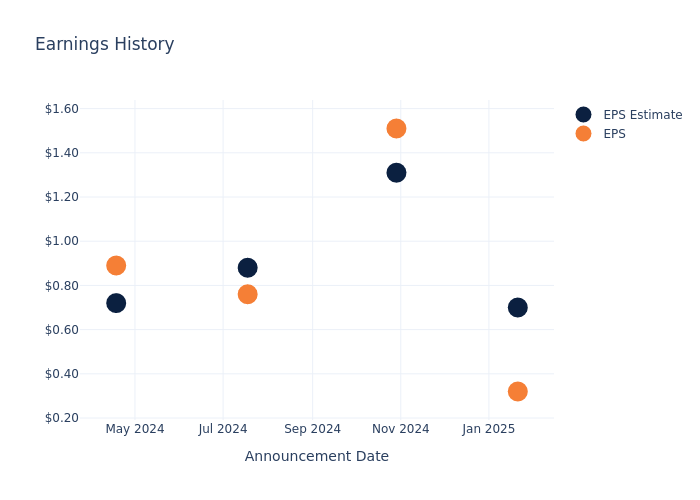

Overview of Past Earnings

The company's EPS missed by $0.38 in the last quarter, leading to a 0.74% drop in the share price on the following day.

Here's a look at Forestar Group's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.70 | 1.31 | 0.88 | 0.72 |

| EPS Actual | 0.32 | 1.51 | 0.76 | 0.89 |

| Price Change % | -1.0% | 1.0% | -2.0% | 1.0% |

Tracking Forestar Group's Stock Performance

Shares of Forestar Group were trading at $19.24 as of April 15. Over the last 52-week period, shares are down 38.47%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Opinions on Forestar Group

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Forestar Group.

A total of 2 analyst ratings have been received for Forestar Group, with the consensus rating being Buy. The average one-year price target stands at $31.0, suggesting a potential 61.12% upside.

Comparing Ratings with Competitors

This comparison focuses on the analyst ratings and average 1-year price targets of and Forestar Group, three major players in the industry, shedding light on their relative performance expectations and market positioning.

Overview of Peer Analysis

In the peer analysis summary, key metrics for and Forestar Group are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Forestar Group | Buy | -18.14% | $55M | 1.03% |

Key Takeaway:

Forestar Group ranks at the bottom for Revenue Growth among its peers. It also ranks at the bottom for Gross Profit. However, it ranks in the middle for Return on Equity.

Delving into Forestar Group's Background

Forestar Group Inc is a residential lot development company with operations across the United States. The core business segment for the company is real estate which generates all of it's revenues. The firm fundamentally acquires entitled real estate and develops it into finished residential lots for sale to homebuilders with a strategic focus on asset turns and efficiency. Single-family residential communities account for the majority of their real estate projects. The company utilizes a lower-risk business model mainly by investing in short duration, phased development projects.

Financial Milestones: Forestar Group's Journey

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Forestar Group's revenue growth over a period of 3 months has faced challenges. As of 31 December, 2024, the company experienced a revenue decline of approximately -18.14%. This indicates a decrease in the company's top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Forestar Group's net margin is impressive, surpassing industry averages. With a net margin of 6.59%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Forestar Group's ROE stands out, surpassing industry averages. With an impressive ROE of 1.03%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Forestar Group's ROA excels beyond industry benchmarks, reaching 0.57%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.51, Forestar Group adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Forestar Group visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal