Better Telecom Stock: AT&T vs. Verizon

Amid recent stock market volatility, the telecom sector offers some respite. Telecom stocks are relatively stable because of the ubiquity and importance of mobile devices in society, allowing telecoms to produce reliable revenue and free cash flow (FCF).

As a testament to this, while many stocks plunged in the past few weeks, shares of telecom giant AT&T (NYSE: T) hit a 52-week high of $29.03 in April, while rival Verizon Communications (NYSE: VZ) reached its high of $47.35 in March.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

As two of the biggest telecom companies in the U.S., AT&T and Verizon make compelling investments. The challenge is choosing between the two competitors. This decision is not straightforward, so let's unpack which looks like the better investment for the long haul right now.

The case for AT&T

Now may be a good time to invest in AT&T because the telecom titan is at an inflection point in its business. The conglomerate emerged from a period of turmoil as it divested entertainment-related assets, such as DIRECTV. It's now focused on expanding its 5G wireless and fiber-optic broadband networks.

This was a smart move, because growing these networks is not cheap. AT&T spent $20.3 billion in capital expenditures last year, and plans to make $22 billion in capital investments this year.

According to CEO John Stankey, these investments are "putting us on a strong foundation to deliver attractive returns for years to come." To his point, in 2024, AT&T's mobile service revenue rose 3.5% year over year to $65.4 billion. Mobile service sales are important, since they contributed the majority of the company's $122.3 billion in 2024 revenue.

AT&T's other growth area is its broadband internet service. AT&T exited 2024 with 14 million broadband connections, which produced $11.2 billion in revenue. This represented a 7% year-over-year sales increase.

The company expects its 2024 success to continue for the next few years in what Stankey called "a new era of growth." AT&T management has forecast mobile service revenue to continue expanding by 2% to 3% annually through 2027.

Free cash flow (FCF) is anticipated to reach at least $16 billion this year and increase by $1 billion annually through 2027. FCF indicates the cash available for dividend payments, so growth in this metric means the company's dividend is secure. At the time of writing, AT&T's dividend yields a beefy 4%.

A look at Verizon

Verizon is a compelling investment because, like AT&T, its mobile service and fiber-optic broadband businesses are growing. Mobile service sales rose 3.1% year over year, contributing $79.1 billion of the telecom's $134.8 billion in total 2024 revenue. The firm expects mobile service sales to grow at least 2% in 2025.

As for its broadband operations, Verizon is aggressively expanding its high-speed fiber-optic network. The company ended 2024 with 12.3 million broadband connections, a 15% year-over-year increase. This growth enabled Verizon's Fios internet service to produce revenue of $12.9 billion in 2024.

The telecom titan seeks to supercharge its broadband growth by acquiring Frontier Communications Parent, the leading U.S. pure-play fiber provider, according to Verizon. Frontier would add about 10 million broadband connections to Verizon's total by 2026, the year the deal is expected to close.

Verizon is also pursuing the artificial intelligence market with its AI Connect service. AI Connect enables tech giants, including Google parent Alphabet, to deliver AI to devices on the edge of a computer network, such as your mobile phone, using Verizon's wireless service.

Deciding between AT&T and Verizon stocks

Both AT&T and Verizon are attractive investments thanks to expanding sales in their key mobile service and fiber internet businesses. But one factor separating them is that AT&T achieved far stronger growth in postpaid phone subscribers, the telecom industry's most valuable customers. In 2024, AT&T attained 1.7 million postpaid phone net additions, nearly double the 887,000 postpaid phone net adds Verizon captured last year.

Still, Verizon offers investors a hefty dividend yield exceeding 6% at the time of writing. Moreover, it's increased the dividend for 18 years straight. AT&T hasn't raised its dividend in years. Verizon can do this because it produces plenty of FCF. In 2024, the company generated FCF of $19.8 billion, up from 2023's $18.7 billion.

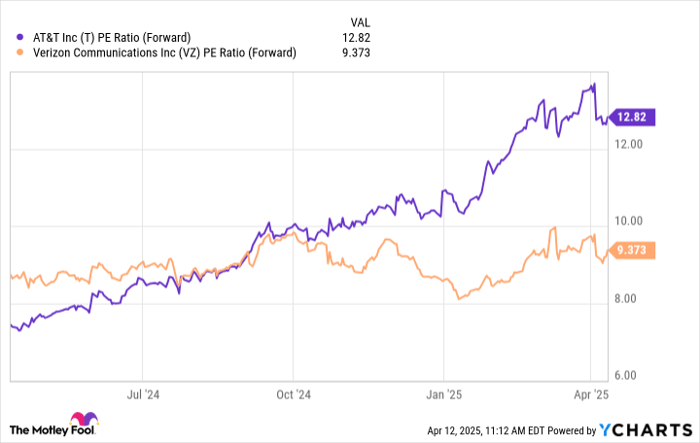

Another factor to consider is stock valuation. To evaluate this, here's a look at the forward price-to-earnings (P/E) ratio. This metric tells you how much investors are willing to pay for a dollar's worth of earnings based on estimates for the next 12 months.

Data by YCharts.

While AT&T's P/E ratio was lower than Verizon's months ago, that's now reversed. Consequently, Verizon stock is the better value at the time of writing. Personally, I like AT&T's growth prospects. But Verizon's better valuation, combined with a rising dividend, the Frontier acquisition, and its AI prospects, gives Verizon the edge as the superior long-term investment.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Robert Izquierdo has positions in AT&T, Alphabet, and Verizon Communications. The Motley Fool has positions in and recommends Alphabet. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

Wall Street Journal

Wall Street Journal