Exploring 3 Undervalued Small Caps With Insider Buying Across Regions

The United States market has shown a robust performance recently, climbing 8.4% over the past week and achieving a 5.9% increase over the last 12 months, with earnings expected to grow at an annual rate of 13%. In this environment, identifying stocks that are potentially undervalued can be appealing, especially when insider buying suggests confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| S&T Bancorp | 9.9x | 3.4x | 47.43% | ★★★★★★ |

| Shore Bancshares | 9.4x | 2.1x | 16.89% | ★★★★★☆ |

| MVB Financial | 10.3x | 1.4x | 39.36% | ★★★★★☆ |

| Flowco Holdings | 6.0x | 0.9x | 41.14% | ★★★★★☆ |

| Thryv Holdings | NA | 0.6x | 32.26% | ★★★★★☆ |

| Columbus McKinnon | 41.5x | 0.4x | 44.99% | ★★★☆☆☆ |

| PDF Solutions | 172.9x | 3.9x | 22.44% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -4.56% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.3x | -3433.57% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -314.78% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Advance Auto Parts (NYSE:AAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Advance Auto Parts is a leading automotive aftermarket parts provider in North America, serving both professional installers and do-it-yourself customers with a market cap of approximately $4.18 billion.

Operations: The company generates revenue primarily from retail auto parts sales, with a recent gross profit margin of 42.22%. Operating expenses constitute a significant portion of costs, driven mainly by general and administrative expenses.

PE: -3.3x

Advance Auto Parts, a smaller player in the auto parts sector, is focusing on growth with plans to open 30 new U.S. locations in 2025 and over 100 more by 2027. Despite recent financial challenges, including a net loss of US$414.78 million for Q4 2024, the company is committed to enhancing customer experience through store upgrades and staff training. Insider confidence is reflected in their strategic expansion efforts rather than share purchases. Future sales projections remain steady at approximately US$9 billion by 2027.

- Click here to discover the nuances of Advance Auto Parts with our detailed analytical valuation report.

Explore historical data to track Advance Auto Parts' performance over time in our Past section.

Kronos Worldwide (NYSE:KRO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kronos Worldwide is a company that focuses on the production and sale of titanium dioxide pigments, with a market capitalization of approximately $1.29 billion.

Operations: The primary revenue stream comes from the production and sale of titanium dioxide pigments. The cost of goods sold (COGS) significantly impacts profitability, with recent figures showing a gross profit margin of 19.15%. Operating expenses have been consistent, affecting net income margins which recently stood at 4.57%.

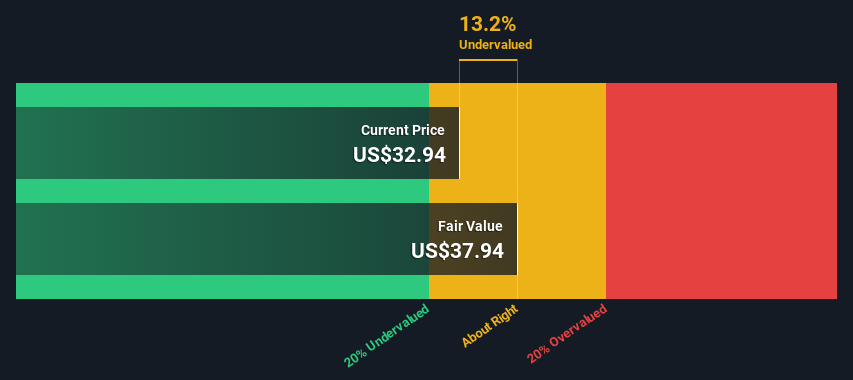

PE: 9.2x

Kronos Worldwide, a smaller U.S. company, shows potential for investors seeking undervalued opportunities. Despite earnings declining by 19% annually over five years, recent results reveal a turnaround with net income reaching US$86 million in 2024 from a previous loss. Sales grew to US$1.89 billion from US$1.67 billion the prior year. The company's reliance on external borrowing poses risks, yet insider confidence is evident with recent share purchases, suggesting optimism about future prospects despite current challenges.

- Dive into the specifics of Kronos Worldwide here with our thorough valuation report.

Assess Kronos Worldwide's past performance with our detailed historical performance reports.

Marriott Vacations Worldwide (NYSE:VAC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Marriott Vacations Worldwide is a global vacation ownership company that operates through segments including Vacation Ownership, Exchange & Third-Party Management, and Corporate and Other, with a market cap of approximately $4.51 billion.

Operations: Marriott Vacations Worldwide generates its revenue primarily from Vacation Ownership, contributing $3.01 billion, followed by Exchange & Third-Party Management at $222 million. The company's gross profit margin has seen fluctuations, peaking at 60.35% in late 2022 before experiencing a decline to 55.74% by the end of 2024. Operating expenses are a significant cost factor, with sales and marketing consistently being the largest component within this category.

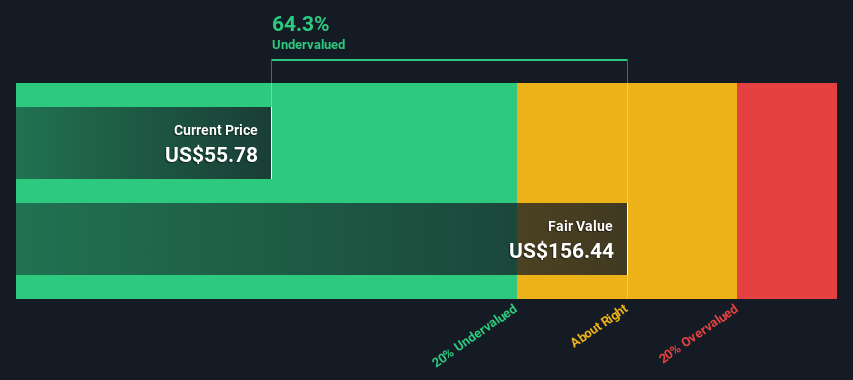

PE: 8.4x

Marriott Vacations Worldwide, a smaller player in the hospitality sector, has shown promising insider confidence with CEO John Geller purchasing 5,000 shares for US$360,200. This move suggests potential value as insiders often buy when they perceive stock to be undervalued. Despite reliance on external borrowing for funding and debt not fully covered by operating cash flow, recent refinancing of an $800 million credit facility enhances financial flexibility. Earnings are forecasted to grow at 18.71% annually, and Q4 2024 saw revenue rise to US$1.3 billion from US$1.2 billion year-on-year. The company anticipates contract sales between $1.85 billion and $1.93 billion in 2025 amidst strategic board changes aimed at strengthening leadership with experienced industry figures like Matthew Avril and Jim Dausch joining as independent directors.

Turning Ideas Into Actions

- Unlock our comprehensive list of 87 Undervalued US Small Caps With Insider Buying by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal