Beyond The Numbers: 11 Analysts Discuss Freeport-McMoRan Stock

During the last three months, 11 analysts shared their evaluations of Freeport-McMoRan (NYSE:FCX), revealing diverse outlooks from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 4 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 3 | 1 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 3 | 0 | 0 |

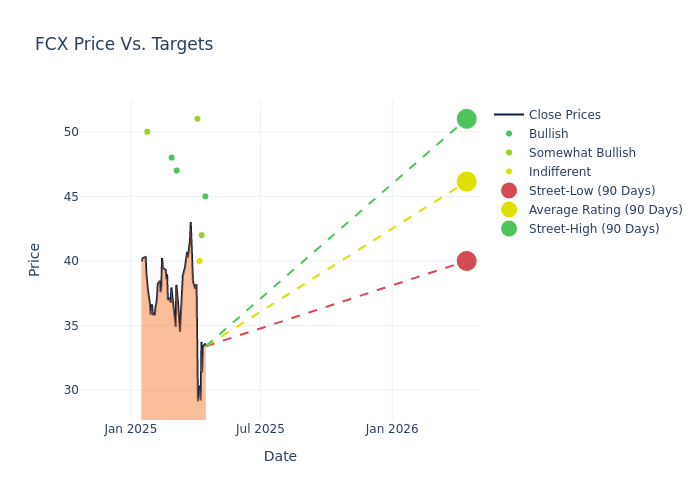

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $46.18, a high estimate of $52.00, and a low estimate of $40.00. A decline of 5.58% from the prior average price target is evident in the current average.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Freeport-McMoRan's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Daniel Major |UBS |Lowers |Buy | $45.00|$52.00 | |Bill Peterson |JP Morgan |Lowers |Overweight | $42.00|$52.00 | |Orest Wowkodaw |Scotiabank |Lowers |Sector Perform | $40.00|$45.00 | |Brian MacArthur |Raymond James |Raises |Outperform | $51.00|$49.00 | |Bill Peterson |JP Morgan |Raises |Overweight | $52.00|$48.00 | |Abhi Agarwal |Deutsche Bank |Maintains |Buy | $47.00|$47.00 | |Chris LaFemina |Jefferies |Raises |Buy | $48.00|$40.00 | |Orest Wowkodaw |Scotiabank |Lowers |Sector Perform | $45.00|$48.00 | |Katja Jancic |BMO Capital |Lowers |Outperform | $50.00|$54.00 | |Chris LaFemina |Jefferies |Lowers |Hold | $40.00|$48.00 | |Bill Peterson |JP Morgan |Lowers |Neutral | $48.00|$55.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Freeport-McMoRan. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Freeport-McMoRan compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Freeport-McMoRan's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Freeport-McMoRan's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Freeport-McMoRan analyst ratings.

Unveiling the Story Behind Freeport-McMoRan

Freeport-McMoRan owns stakes in 10 copper mines, led by its 49% ownership of the Grasberg copper and gold operations in Indonesia, 55% of the Cerro Verde mine in Peru, and 72% of Morenci in Arizona. It sold around 1.2 million metric tons of copper (its share) in 2024, making it the one of the world's largest copper miners by volume. It also sold about 900,000 ounces of gold, mostly from Grasberg, and 70 million pounds of molybdenum. It had about 25 years of copper reserves at the end of December 2024. We expect it to sell similar amounts of copper midcycle in 2029, though we expect gold volumes to decline to about 700,000 ounces then due to falling production at Grasberg.

Freeport-McMoRan: A Financial Overview

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Freeport-McMoRan's revenue growth over a period of 3M has faced challenges. As of 31 December, 2024, the company experienced a revenue decline of approximately -3.13%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Materials sector.

Net Margin: Freeport-McMoRan's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 4.79%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.56%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Freeport-McMoRan's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.5%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Freeport-McMoRan's debt-to-equity ratio stands notably higher than the industry average, reaching 0.55. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

What Are Analyst Ratings?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal