Arthur J. Gallagher (NYSE:AJG) Reports Increased Earnings Driving Revenue Growth

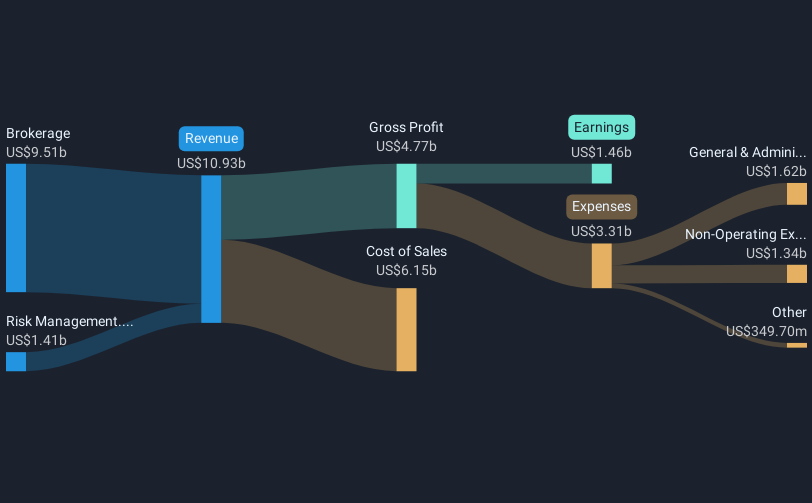

Arthur J. Gallagher (NYSE:AJG) recently amended its Credit Agreement, extending maturity and increasing commitments, which may provide the company with more financial flexibility. This organizational update, alongside improved earnings results indicating increased revenue and net income, could have played a supportive role in the company’s 19% price increase over the last quarter. The broader market also experienced upward momentum, led by gains in the banking and tech sectors. The company's dividend increase and positive earnings report aligns with overall market growth trends, adding further weight to its share price rise.

The recent amendment to Arthur J. Gallagher's Credit Agreement not only extends maturity and increases financial commitments but potentially impacts the broader growth narrative centered around the acquisition of AssuredPartners. This acquisition is poised to bolster Gallagher's market reach and cross-selling capabilities, potentially influencing future revenue and earnings positively. The organizational move, coupled with favorable earnings results, aligns with recent share price momentum, reflecting investor confidence in these strategic efforts.

Over the past five years, Gallagher's shares, including dividends, have shown a substantial total return of 350.33%. This impressive growth underscores the company's strong performance and positions it as a standout in its sector. More recently, Gallagher's annual performance has also surpassed the US Insurance industry, which saw a return of 19.4% over the past year, highlighting its robust growth trajectory.

Looking ahead, the positive news surrounding the Credit Agreement could further support bullish revenue and earnings forecasts, with projections estimating George Gallagher’s revenue to grow by 12.9% annually. This aligns the company's strategic goals with its financial targets, while the share price's 19% increase against a consensus price target indicates a modest difference of about 5.4%, suggesting analysts see the stock as fairly valued despite its recent gains. As analysts anticipate earnings of $3 billion by 2028, these developments fortify Gallagher's financial outlook amidst execution risks from acquisitions and macroeconomic challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal