3 Stocks Estimated To Be Up To 26.2% Below Intrinsic Value

As the U.S. stock market experiences a lift led by banks and tech sectors, investors are navigating a landscape marked by trade tensions with China and fluctuating indices. In this environment, identifying undervalued stocks—those trading below their intrinsic value—can offer opportunities for growth as they may be poised to benefit from future market adjustments.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | $18.61 | $36.91 | 49.6% |

| Truist Financial (NYSE:TFC) | $36.18 | $72.26 | 49.9% |

| First Bancorp (NasdaqGS:FBNC) | $36.44 | $72.67 | 49.9% |

| Heritage Financial (NasdaqGS:HFWA) | $21.21 | $42.07 | 49.6% |

| First Reliance Bancshares (OTCPK:FSRL) | $9.35 | $18.55 | 49.6% |

| Flotek Industries (NYSE:FTK) | $6.60 | $13.07 | 49.5% |

| Bel Fuse (NasdaqGS:BELF.A) | $66.95 | $132.55 | 49.5% |

| Veracyte (NasdaqGM:VCYT) | $32.14 | $63.64 | 49.5% |

| Sotera Health (NasdaqGS:SHC) | $10.62 | $20.97 | 49.4% |

| CNX Resources (NYSE:CNX) | $30.67 | $60.67 | 49.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Li Auto (NasdaqGS:LI)

Overview: Li Auto Inc. operates in the energy vehicle market in the People's Republic of China with a market cap of approximately $23.54 billion.

Operations: The company's revenue primarily comes from its auto manufacturing segment, which generated CN¥144.46 billion.

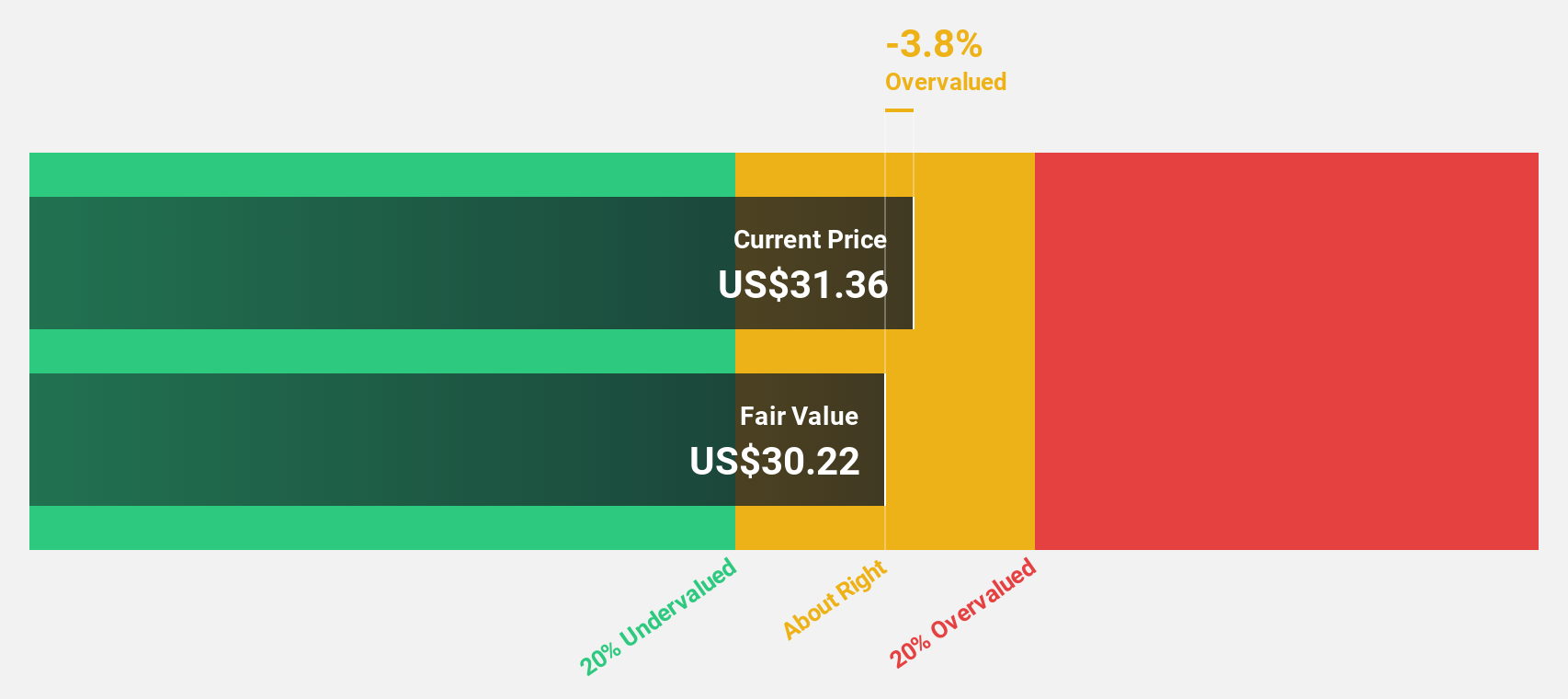

Estimated Discount To Fair Value: 11%

Li Auto is trading at US$23.85, below its estimated fair value of US$26.81, suggesting potential undervaluation based on cash flows. Despite a decline in profit margins from 9.5% to 5.6%, the company's earnings are expected to grow significantly at 22.8% annually, outpacing the broader US market's growth rate of 13.5%. Recent deliveries have shown strong year-over-year increases, aligning with positive analyst sentiment forecasting a stock price rise of 37.4%.

- Our comprehensive growth report raises the possibility that Li Auto is poised for substantial financial growth.

- Dive into the specifics of Li Auto here with our thorough financial health report.

Micron Technology (NasdaqGS:MU)

Overview: Micron Technology, Inc. is a company that designs, develops, manufactures, and sells memory and storage products globally with a market cap of approximately $77.73 billion.

Operations: Micron's revenue is primarily derived from its Compute and Networking Business Unit at $14.55 billion, followed by the Storage Business Unit at $6.16 billion, the Mobile Business Unit at $6.06 billion, and the Embedded Business Unit at $4.54 billion.

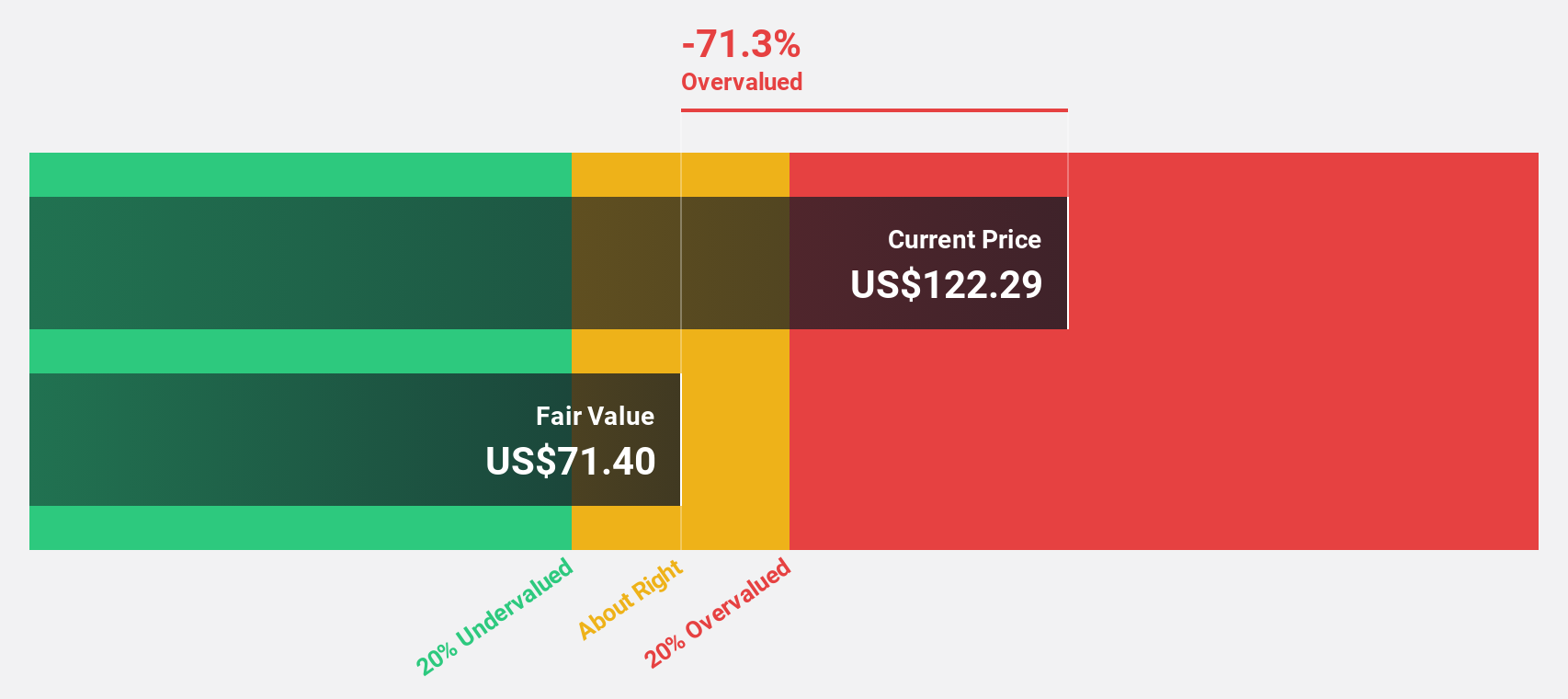

Estimated Discount To Fair Value: 26.2%

Micron Technology is trading at US$71.02, considerably below its estimated fair value of US$96.2, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 26.8% annually, surpassing the broader US market's growth rate of 13.5%. Recent product announcements underscore Micron's leadership in AI memory solutions and data center applications, which may bolster future revenue streams despite recent share price volatility and zero buyback activity in early 2025.

- Our expertly prepared growth report on Micron Technology implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Micron Technology's balance sheet by reading our health report here.

Willis Towers Watson (NasdaqGS:WTW)

Overview: Willis Towers Watson Public Limited Company is a global advisory, broking, and solutions firm with a market capitalization of approximately $32.08 billion.

Operations: The company's revenue is primarily generated from two segments: Risk & Broking, which accounts for $4.04 billion, and Health, Wealth & Career, contributing $5.78 billion.

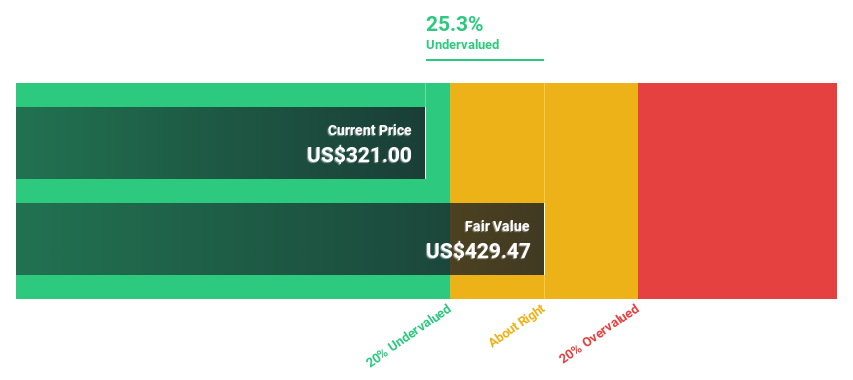

Estimated Discount To Fair Value: 23.8%

Willis Towers Watson is trading at US$328.02, significantly below its estimated fair value of US$430.26, suggesting undervaluation based on cash flows. Despite high debt levels and recent insider selling, the company's earnings are forecast to grow 31.98% annually over the next three years, outpacing market averages. Recent partnerships and digital innovations like Neuron enhance its strategic position in insurance analytics and risk management, potentially supporting long-term profitability despite slower revenue growth projections compared to the broader market.

- Our earnings growth report unveils the potential for significant increases in Willis Towers Watson's future results.

- Click here to discover the nuances of Willis Towers Watson with our detailed financial health report.

Make It Happen

- Unlock our comprehensive list of 180 Undervalued US Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal