2 Top Tech Stocks That Could Make You a Millionaire

Technology stocks are tumbling. A tariff war has started between the United States and China, injecting uncertainty into the stock market. While stocks rallied this week, the Nasdaq-100 index is still off 16% from all-time highs set earlier this year. Volatility is off the charts, and it is unclear what comes next with sky-high tariffs putting up huge trade barriers between the world's two largest economies.

Given how unpredictable these tariffs are, the best move may be to look for high-quality stocks that are unaffected by China and United States foreign trade, meaning companies that don't ship physical goods from China to the States or vice versa. This could include software companies or international stocks, among other candidates. I have two that fit the bill perfectly.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Here are two top technology stocks that can make you a millionaire through all market environments.

Betting on big tech outside of China

Plenty of large technology companies could be impacted by this trade war, namely Apple and Amazon. Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) should be more immune. Its Google and YouTube properties have been unable to operate in China for years, and it doesn't ship any physical goods from China that would be affected by tariffs.

Alphabet is a long-term growth investment in artificial intelligence (AI). AI is making Google Search, YouTube, and new consumer products like Gemini more powerful for users. And the industry is just at the beginning of this growth in spending on AI tools. Third-party estimates have the category growing at a 30%-plus annual rate through 2030 to reach total annual spend of more than $1 trillion. As a leader in this space, Alphabet is in pole position to capture a lot of this consumer and commercial spending.

Most promising may be the growth of Google Cloud. The data center and cloud computing division is the backbone for AI tools, growing revenue 30% year over year to $12 billion last quarter. Fast growth should be expected for the rest of the decade, and it wouldn't be surprising if the division reached $100 billion in annual revenue within the next few years.

Today, you can buy Alphabet stock at a price-to-earnings ratio (P/E) below 20, which is much cheaper than the average technology stock. For a beneficiary of AI and a long-term revenue grower, this seems like a dirt cheap price and why I think Alphabet stock is a millionaire maker at current prices.

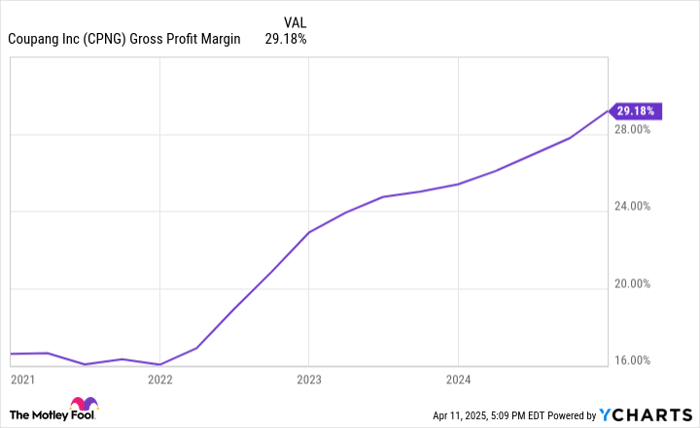

CPNG Gross Profit Margin data by YCharts

Diversifying outside of America

Another way to avoid this tariff calamity is to diversify to high-quality stocks outside of America. Coupang (NYSE: CPNG) is a great company that operates in South Korea. It is an e-commerce platform in a similar vein to Amazon and is growing market share rapidly in the nation with its high quality and fast delivery services.

Last quarter, Coupang's revenue grew 28% year over year in South Korean won terms (adjusting for U.S. dollar exchange rate) to $8 billion. Its gross profit margin keeps rising, hitting close to 30% over the last 12 months. With plenty of room to gain market share and the addition of add-on services like advertising, TV streaming, and food delivery, Coupang should grow both its revenue and profit margins in the years to come.

Plus, it is expanding into Taiwan, where revenue is growing 23% quarter over quarter, albeit from a small base. Over the next few years, Coupang's annual revenue can grow to $50 billion compared to $30 billion in 2024 with bottom-line profit margin potential of 10%. That would equate to $5 billion in annual net earnings.

Today, Coupang trades at a market cap of $39 billion, or less than 10 times what I believe the company can earn in net income just a few years from now. From my seat, this looks like a stock that can make investors rich as long as you buy and hold for the long term.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Brett Schafer has positions in Alphabet, Amazon, and Coupang. The Motley Fool has positions in and recommends Alphabet, Amazon, and Apple. The Motley Fool recommends Coupang. The Motley Fool has a disclosure policy.

Wall Street Journal

Wall Street Journal