Zimmer Biomet Holdings (NYSE:ZBH) Proposes Officer Exculpation Amendment at Upcoming Shareholder Meeting

Zimmer Biomet Holdings (NYSE:ZBH) recently announced proposed changes to its corporate governance structure, aiming to amend its Restated Certificate of Incorporation. This amendment, which will be discussed at the annual shareholders' meeting, potentially added to the 2% price decline over the last quarter, amidst a broader market uptick of 5.8% in recent days. Other than corporate governance, factors like a decrease in net income in the latest earnings report, down from the previous year, might have further influenced the declines. The company's moves were against the backdrop of a stronger market and significant gains in technology stocks recently.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Despite recent governance changes potentially leading to a 2% share price decline over the past quarter, Zimmer Biomet Holdings' stock has experienced a longer-term return of 6.27% decline over five years, including dividends. This underperformance contrasts with the broader market's upward movement, suggesting that Zimmer Biomet may face challenges in matching industry growth over the short term.

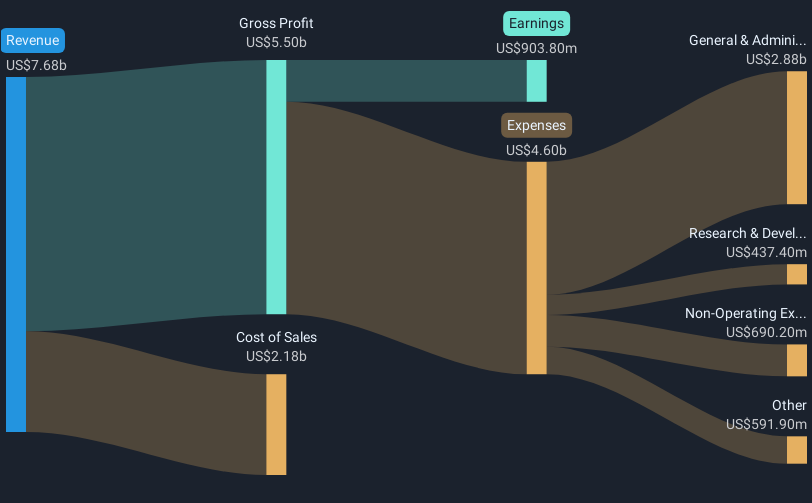

With recent shifts in corporate governance, ongoing revenue growth concerns, and earnings forecasts that indicate modest increases, the potential revenue and earnings impact remains uncertain. Notably, Zimmer Biomet's acquisition of Paragon 28 and numerous product launches could contribute positively, although risks such as ERP system integration and pricing pressures continue to loom. Analysts anticipate revenue to grow by 3.8% annually over the next three years, potentially elevating earnings to $1.4 billion.

Trading currently at US$102.79, Zimmer Biomet's shares are at a 15.9% discount to the consensus analyst price target of US$122.31. The company remains focused on boosting its financial performance, but investors should consider the balance of growth opportunities against integration and operational challenges that may limit near-term performance relative to the market and industry trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal