Forecasting The Future: 4 Analyst Projections For Holley

Throughout the last three months, 4 analysts have evaluated Holley (NYSE:HLLY), offering a diverse set of opinions from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 3 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

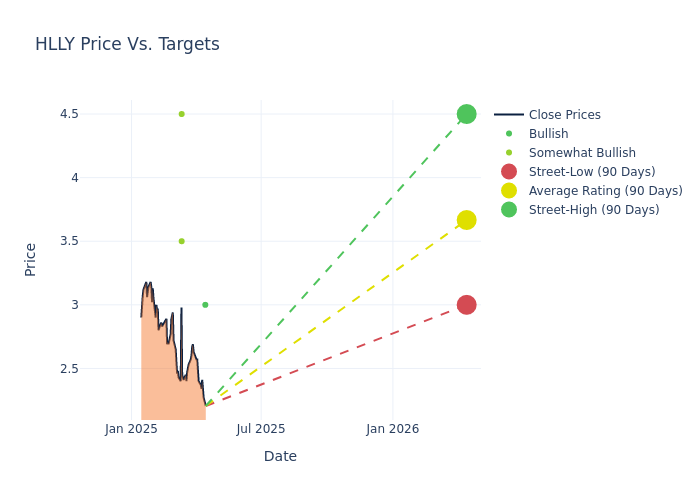

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $3.88, along with a high estimate of $4.50 and a low estimate of $3.00. Experiencing a 8.71% decline, the current average is now lower than the previous average price target of $4.25.

Diving into Analyst Ratings: An In-Depth Exploration

An in-depth analysis of recent analyst actions unveils how financial experts perceive Holley. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|---------------------|---------------|---------------|--------------------|--------------------| |Michael Swartz |Truist Securities |Lowers |Buy | $3.00|$5.00 | |Joseph Altobello |Raymond James |Raises |Outperform | $3.50|$3.00 | |Joseph Feldman |Telsey Advisory Group|Maintains |Outperform | $4.50|$4.50 | |Joseph Feldman |Telsey Advisory Group|Maintains |Outperform | $4.50|$4.50 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Holley. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Holley compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Holley's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Holley's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Holley analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Unveiling the Story Behind Holley

Holley Inc is a designer, marketer, and manufacturer of high-performance automotive aftermarket products, featuring a portfolio of iconic brands serving the car and truck industry. It offers a diversified line of performance automotive products including fuel injection systems, tuners, exhaust products, carburetors, safety equipment and various other performance automotive products. The Company's products are designed to enhance street, off-road, recreational and competitive vehicle performance through increased horsepower, torque and drivability. The company's brands include Holley, APR, MSD and Flowmaster, among others. It derives revenue from the U.S. and Italy, of which prime revenue is derived from the U.S.

Key Indicators: Holley's Financial Health

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, Holley faced challenges, resulting in a decline of approximately -10.05% in revenue growth as of 31 December, 2024. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -26.98%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Holley's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -8.59%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Holley's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -3.26%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.32, caution is advised due to increased financial risk.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal