What Analysts Are Saying About Integer Holdings Stock

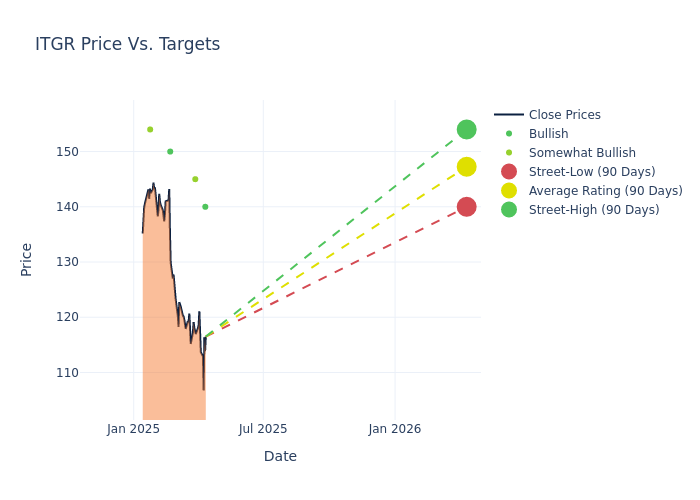

In the latest quarter, 4 analysts provided ratings for Integer Holdings (NYSE:ITGR), showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

The 12-month price targets, analyzed by analysts, offer insights with an average target of $147.25, a high estimate of $154.00, and a low estimate of $140.00. Highlighting a 1.17% decrease, the current average has fallen from the previous average price target of $149.00.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Integer Holdings is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Richard Newitter |Truist Securities |Lowers |Buy | $140.00|$163.00 | |Andrew Cooper |Raymond James |Announces |Outperform | $145.00|- | |Robert Wasserman |Benchmark |Raises |Buy | $150.00|$140.00 | |Brett Fishbin |Keybanc |Raises |Overweight | $154.00|$144.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Integer Holdings. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Integer Holdings compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Integer Holdings's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Integer Holdings analyst ratings.

All You Need to Know About Integer Holdings

Integer Holdings Corp is a manufacturer of medical device components used by original equipment manufacturers in the medical industry. The company also develops batteries used in nonmedical applications in the energy, military, and environmental markets. The firm organizes itself into one segment and derives its revenues from three product lines: Cardio & Vascular, Cardiac Rhythm Management & Neuromodulation and Other Markets. The company earns more than half of its revenue in the United States.

Integer Holdings: Financial Performance Dissected

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Integer Holdings displayed positive results in 3M. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 11.12%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Integer Holdings's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 7.28%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Integer Holdings's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.02%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Integer Holdings's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 1.05%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Integer Holdings's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.68.

How Are Analyst Ratings Determined?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal