Analyst Expectations For C.H. Robinson Worldwide's Future

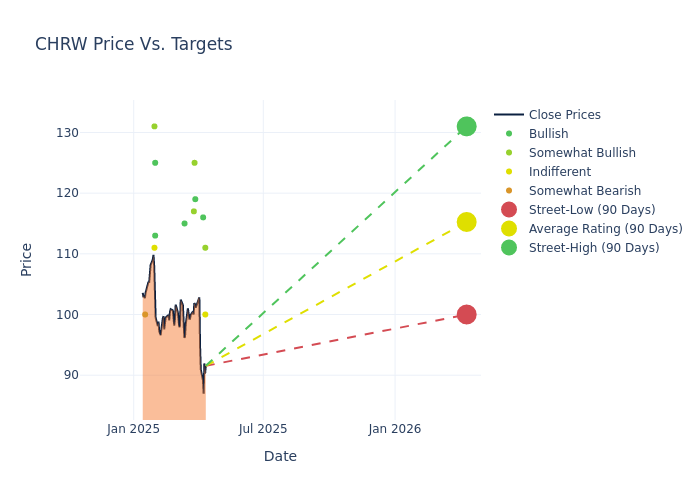

In the last three months, 17 analysts have published ratings on C.H. Robinson Worldwide (NASDAQ:CHRW), offering a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 7 | 6 | 3 | 1 | 0 |

| Last 30D | 0 | 1 | 1 | 0 | 0 |

| 1M Ago | 3 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 4 | 3 | 2 | 1 | 0 |

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $116.88, a high estimate of $131.00, and a low estimate of $100.00. This current average has decreased by 3.25% from the previous average price target of $120.81.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of C.H. Robinson Worldwide among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Stephanie Moore |Jefferies |Lowers |Hold | $100.00|$110.00 | |David Hicks |Raymond James |Lowers |Outperform | $111.00|$118.00 | |Ariel Rosa |Citigroup |Lowers |Buy | $116.00|$124.00 | |Ken Hoexter |B of A Securities |Lowers |Buy | $119.00|$122.00 | |Christian Wetherbee |Wells Fargo |Lowers |Overweight | $125.00|$130.00 | |Bascome Majors |Susquehanna |Lowers |Positive | $117.00|$127.00 | |Lucas Servera |Truist Securities |Announces |Buy | $115.00|- | |Ariel Rosa |Citigroup |Lowers |Buy | $124.00|$130.00 | |Christopher Kuhn |Benchmark |Maintains |Buy | $125.00|$125.00 | |J. Bruce Chan |Stifel |Maintains |Buy | $113.00|$113.00 | |Ken Hoexter |B of A Securities |Lowers |Buy | $122.00|$130.00 | |Brian Ossenbeck |JP Morgan |Lowers |Overweight | $131.00|$133.00 | |Daniel Imbro |Stephens & Co. |Maintains |Equal-Weight | $111.00|$111.00 | |Bascome Majors |Susquehanna |Lowers |Positive | $127.00|$130.00 | |David Hicks |Raymond James |Lowers |Outperform | $118.00|$123.00 | |J. Bruce Chan |Stifel |Raises |Hold | $113.00|$112.00 | |Brandon Oglenski |Barclays |Raises |Underweight | $100.00|$95.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to C.H. Robinson Worldwide. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of C.H. Robinson Worldwide compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of C.H. Robinson Worldwide's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of C.H. Robinson Worldwide's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on C.H. Robinson Worldwide analyst ratings.

About C.H. Robinson Worldwide

C.H. Robinson is a top-tier non-asset-based third-party logistics provider with a significant focus on domestic freight brokerage (about 60% of net revenue), which reflects mostly truck brokerage but also rail intermodal. Additionally, the firm operates a large air and ocean forwarding division (30%), which has grown organically and via tuck-in acquisitions over the years. The remainder of revenue consists of transportation management services and a legacy produce-sourcing operation.

C.H. Robinson Worldwide: Financial Performance Dissected

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Negative Revenue Trend: Examining C.H. Robinson Worldwide's financials over 3M reveals challenges. As of 31 December, 2024, the company experienced a decline of approximately -0.88% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 3.57%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): C.H. Robinson Worldwide's ROE excels beyond industry benchmarks, reaching 8.88%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.74%, the company showcases effective utilization of assets.

Debt Management: C.H. Robinson Worldwide's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.01.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal