Forecasting The Future: 9 Analyst Projections For Republic Services

Analysts' ratings for Republic Services (NYSE:RSG) over the last quarter vary from bullish to bearish, as provided by 9 analysts.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 1 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 3 | 1 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

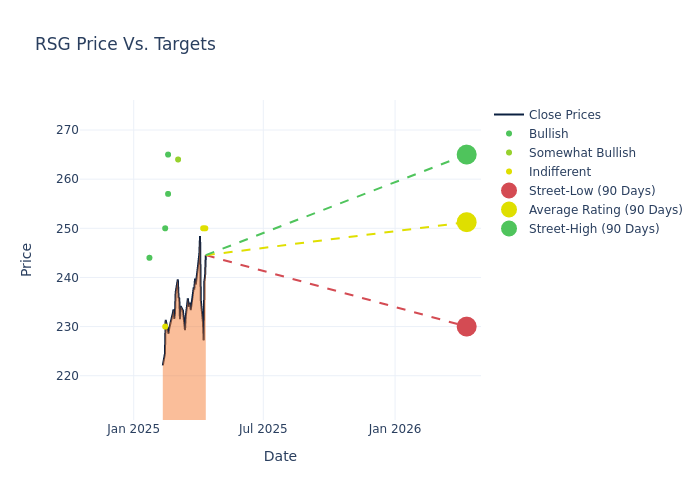

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $250.0, a high estimate of $265.00, and a low estimate of $230.00. Witnessing a positive shift, the current average has risen by 7.35% from the previous average price target of $232.88.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Republic Services among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|-----------------|--------------------|--------------------| |Jon Windham |UBS |Raises |Neutral | $250.00|$240.00 | |Konark Gupta |Scotiabank |Raises |Sector Perform | $250.00|$233.00 | |Kevin Chiang |CIBC |Announces |Sector Outperform| $264.00|- | |Jon Windham |UBS |Raises |Neutral | $240.00|$212.00 | |Jerry Revich |Goldman Sachs |Raises |Buy | $265.00|$239.00 | |Michael Hoffman |Stifel |Raises |Buy | $257.00|$240.00 | |Tobey Sommer |Truist Securities |Raises |Buy | $250.00|$244.00 | |Toni Kaplan |Morgan Stanley |Raises |Equal-Weight | $230.00|$220.00 | |Stephanie Moore |Jefferies |Raises |Buy | $244.00|$235.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Republic Services. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Republic Services compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Republic Services's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Republic Services's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Republic Services analyst ratings.

Unveiling the Story Behind Republic Services

Republic Services is the second-largest integrated provider of traditional solid waste services in the United States, operating roughly 207 active landfills and 246 transfer stations. The company serves residential, commercial, and industrial end markets. It also runs a sizable recycling operation in North America.

Republic Services's Financial Performance

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Republic Services's remarkable performance in 3M is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 5.58%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 12.65%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.52%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Republic Services's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.59% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Republic Services's debt-to-equity ratio is below the industry average. With a ratio of 1.14, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal