Martin Marietta Materials (NYSE:MLM) Announces CFO Resignation and Interim Appointment

Martin Marietta Materials (NYSE:MLM) recently experienced changes in its executive ranks with the resignation of CFO James A.J. Nickolas and the appointment of Robert J. Cardin as interim CFO. Additionally, the company provided guidance expecting revenues of $1.353 billion for Q1 2025. Over the past month, MLM's stock rose by 2%, influenced perhaps by these corporate developments. This price movement occurred in a volatile market landscape marked by broader concerns over tariffs and fluctuating major indexes. These corporate actions offered a stabilizing factor in contrast to the broader market's flat trend within the same period.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

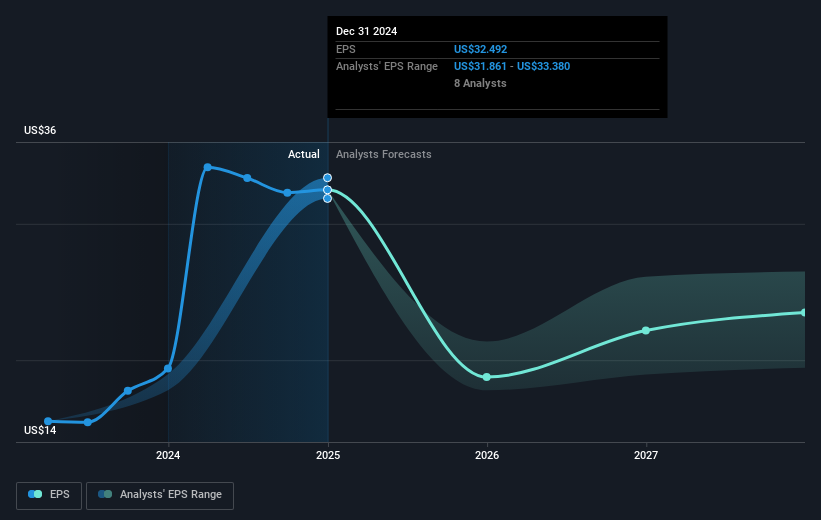

The recent changes in Martin Marietta Materials' executive team and its guidance for Q1 2025 revenue are poised to influence its operational narrative. The appointment of Robert J. Cardin as interim CFO and the revenue guidance of US$1.35 billion may bolster investor confidence amidst volatility, potentially enhancing the company's shipment growth and revenue, given its strategic focus on infrastructure and data center demand. However, macroeconomic uncertainties could continue to pose challenges to profitability, impacting revenue and earnings forecasts.

Over the past five years, Martin Marietta's total shareholder return, including stock price appreciation and dividends, was 162.53%. This long-term performance underscores the company's capacity for resilience against market fluctuations. Nonetheless, over the past year, the stock has underperformed compared to the U.S. market's return of 4.7% and the U.S. Basic Materials industry, which returned a decline of 4.4%.

Currently, MLM's share price of US$452.51 suggests a discount of approximately 24% to analysts' consensus price target of US$590. This highlights a belief in the company's underlying value despite forecasts of declining earnings. Market participants should consider this discount and form their own assessments of MLM's future potential against shifts in infrastructure investment trends and the broader economic landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal