Hesai Group (NASDAQ:HSAI) Stocks Pounded By 48% But Not Lagging Industry On Growth Or Pricing

Hesai Group (NASDAQ:HSAI) shares have had a horrible month, losing 48% after a relatively good period beforehand. The good news is that in the last year, the stock has shone bright like a diamond, gaining 144%.

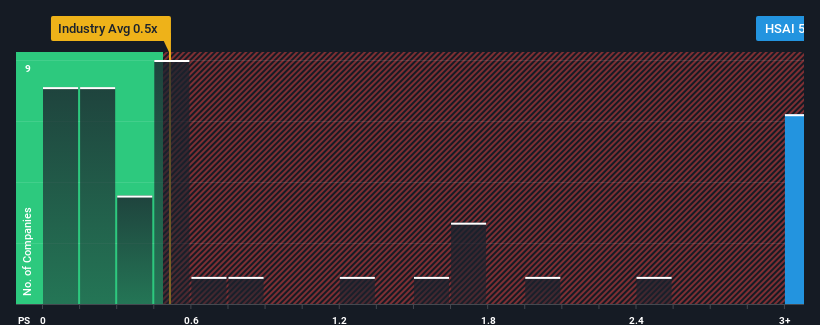

In spite of the heavy fall in price, given around half the companies in the United States' Auto Components industry have price-to-sales ratios (or "P/S") below 0.5x, you may still consider Hesai Group as a stock to avoid entirely with its 5.9x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Hesai Group

How Hesai Group Has Been Performing

Hesai Group certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Hesai Group will help you uncover what's on the horizon.How Is Hesai Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Hesai Group's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen an excellent 188% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 43% per annum during the coming three years according to the analysts following the company. With the industry only predicted to deliver 36% per annum, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Hesai Group's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Hesai Group's P/S

Hesai Group's shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Hesai Group shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Hesai Group that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal