6 Analysts Have This To Say About Adient

In the last three months, 6 analysts have published ratings on Adient (NYSE:ADNT), offering a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 4 | 2 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 2 | 0 |

| 3M Ago | 0 | 0 | 3 | 0 | 0 |

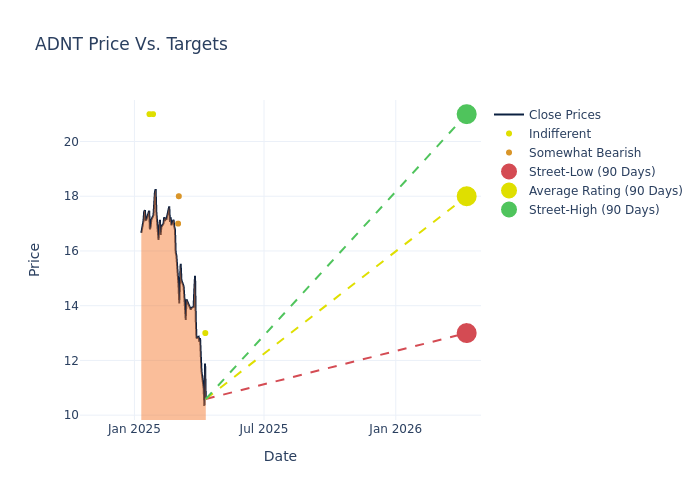

Analysts have set 12-month price targets for Adient, revealing an average target of $18.33, a high estimate of $21.00, and a low estimate of $13.00. This current average represents a 15.41% decrease from the previous average price target of $21.67.

Analyzing Analyst Ratings: A Detailed Breakdown

The analysis of recent analyst actions sheds light on the perception of Adient by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|---------------|--------------------|--------------------| |Joseph Spak |UBS |Lowers |Neutral | $13.00|$20.00 | |John Murphy |B of A Securities |Lowers |Underperform | $18.00|$24.00 | |Adam Jonas |Morgan Stanley |Lowers |Underweight | $17.00|$19.00 | |Joseph Spak |UBS |Raises |Neutral | $20.00|$19.00 | |Ryan Brinkman |JP Morgan |Lowers |Neutral | $21.00|$24.00 | |Dan Levy |Barclays |Lowers |Equal-Weight | $21.00|$24.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Adient. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Adient compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Adient's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Adient analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Adient: A Closer Look

Adient began trading Oct. 31, 2016, when Johnson Controls spun off its automotive experience segment. Adient is the leading seating supplier to the industry with about one third of the global market. Its share in China is now nearly 20%, down from about 45%, following the sale of its main joint venture there at the end of fiscal 2021. Unconsolidated revenue from joint ventures was about $3.8 billion in fiscal 2024 and consolidated China revenue was $1.4 billion. The company is headquartered in Ireland but has corporate offices in the Detroit area. Fiscal 2024 (Sept. 30 year-end) consolidated revenue, which excludes joint venture sales, was $14.7 billion.

Key Indicators: Adient's Financial Health

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Decline in Revenue: Over the 3M period, Adient faced challenges, resulting in a decline of approximately -4.51% in revenue growth as of 31 December, 2024. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: Adient's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 0.0%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 0.0%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Adient's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.0%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.28, caution is advised due to increased financial risk.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal