Jackson Finl Stock: A Deep Dive Into Analyst Perspectives (4 Ratings)

Throughout the last three months, 4 analysts have evaluated Jackson Finl (NYSE:JXN), offering a diverse set of opinions from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

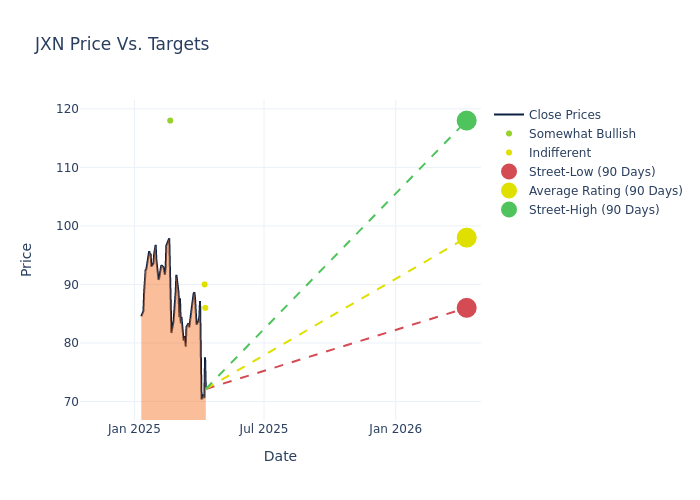

In the assessment of 12-month price targets, analysts unveil insights for Jackson Finl, presenting an average target of $99.75, a high estimate of $118.00, and a low estimate of $86.00. A 4.09% drop is evident in the current average compared to the previous average price target of $104.00.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of Jackson Finl by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|-----------------------|---------------|---------------|--------------------|--------------------| |Nigel Dally |Morgan Stanley |Lowers |Equal-Weight | $86.00|$92.00 | |Ryan Krueger |Keefe, Bruyette & Woods|Lowers |Market Perform | $90.00|$105.00 | |Ryan Krueger |Keefe, Bruyette & Woods|Raises |Market Perform | $105.00|$103.00 | |Alex Scott |Barclays |Raises |Overweight | $118.00|$116.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Jackson Finl. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Jackson Finl compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Jackson Finl's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Jackson Finl's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Jackson Finl analyst ratings.

Get to Know Jackson Finl Better

Jackson Financial Inc helps Americans grow and protect their retirement savings and income to enable them to pursue financial freedom for life. Its retail product offerings are comprised of annuities, designed to help retail investors save for and live in retirement. Its diverse suite of annuities includes a variable, fixed index, and fixed annuities. The company manages its business through three segments: Retail Annuities, Institutional Products, and Closed Life and Annuity Blocks and Corporate and Other segments. The company generates the majority of its revenue from the Retail Annuities segment, which offers a variety of retirement income and savings products of variable annuities, registered index-linked annuities ("RILA"), fixed index annuities, fixed annuities, and payout annuities.

Jackson Finl's Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Negative Revenue Trend: Examining Jackson Finl's financials over 3M reveals challenges. As of 31 December, 2024, the company experienced a decline of approximately -82.35% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Jackson Finl's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 211.39%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 3.44%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.1%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.47, Jackson Finl adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal