Trump's 90-Day Tariff Pause Sends RH Stock Surging, Reversing Heavy Losses from Earnings Miss, Trade War Fears

Luxury home furnishings company, RH (NYSE:RH), formerly known as Restoration Hardware, led the market rally on Wednesday, up 29%, after President Donald Trump announced that he would be pausing the tariffs for 90 days across all countries, except China.

What Happened: This comes just days after the stock plunged over 40% following a double whammy of disappointing fourth-quarter earnings results, and the massive ‘Liberation Day’ tariffs affecting most of RH’s top sourcing and supplier locations.

The company missed consensus estimates on revenue and earnings, with CEO Gary Friedman claiming during the call that they were operating in “the worst housing market in almost 50 years,” before adding that he also expects a “higher-risk business environment this year, due to the uncertainty caused by tariffs, market volatility, and inflation risk.”

Despite the pullback, several analysts reiterated their bullish stance on the stock, such as Cristina Fernández of Telsey Advisory Group, who maintained an ‘Outperform’ rating and the price target of $280, claiming that the company “has the potential to weather tariffs as its higher price points and affluent consumer base give it more pricing power.”

The bullish consensus, alongside the pausing of the tariffs, led to a rally in the stock, even though it remains down 20% this month, 51% year-to-date, and 73% since its all-time high in 2021.

Why It Matters: According to RH’s recent 10K filings, just about 23% of its merchandise, valued at $713 million, was sourced from China in 2024. This is down from 40% in 2017, made possible by extensive diversification efforts, in favor of other Asian manufacturing hubs, such as Vietnam, from where it now sources 35% of its products, worth $1.09 billion.

The rest of it comes from a few other Asian countries, such as India and Indonesia, at 14%, followed by 18% from North America and 10% from Europe. This leaves the company significantly less exposed to the tariffs than previously thought.

Price Action: RH was up 28.57% on Wednesday before closing at $192.08 per share, and is down by 1.58% in after-hours trading.

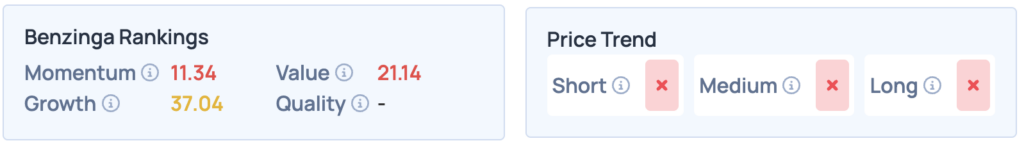

RH’s scores still don’t seem all that favorable on Benzinga’s Edge Rankings, but what about its competitors, Williams Sonoma and Arhaus? Sign up for Benzinga Edge today.

Read More:

Photo courtesy: Shutterstock

Wall Street Journal

Wall Street Journal