Extra Space Storage (NYSE:EXR) Sees 14% Share Price Decline Over The Past Week

Extra Space Storage (NYSE:EXR) experienced a 14% decline in its share price over the past week. This movement mirrors broader market trends, as the Dow Jones and S&P 500 indexes also saw significant declines amidst heightened volatility and economic uncertainty spurred by newly imposed tariffs. The persistent market-wide retreat suggests that any events specific to Extra Space Storage during this period would have been weighted against the broader bearish sentiment affecting equities, rather than driving unique or divergent market reactions for the company. Therefore, the company's price move seems aligned with the general negative market direction.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent 14% decline in Extra Space Storage's share price, alongside broader market fluctuations, highlights the interconnectedness of the company's performance with broader economic conditions such as newly imposed tariffs. While short-term market volatility presents challenges, it is important to consider the longer-term trajectory. Over the past five years, Extra Space Storage's total shareholder return, incorporating both share price and dividends, has been 59.03%. This figure provides a contrasting perspective to the recent downturn and underscores the importance of viewing performance over multiple time horizons.

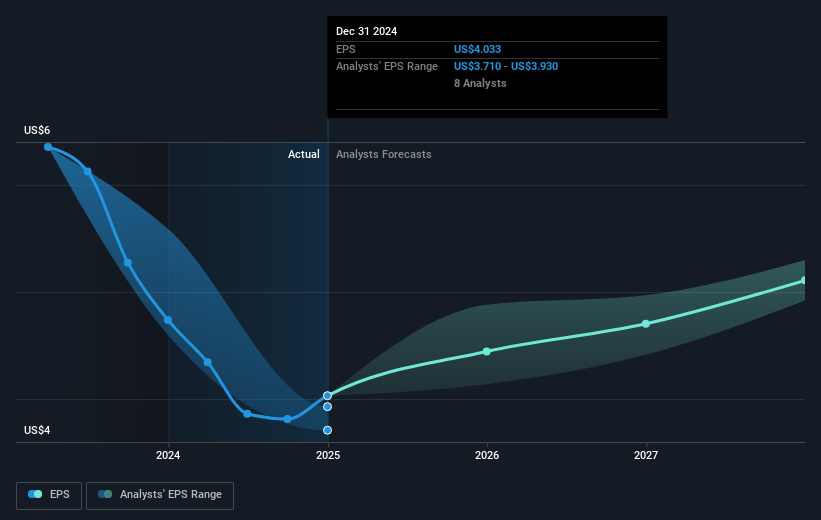

Over the past year, Extra Space Storage underperformed the US market, returning 3.8%, and trailed behind the US Specialized REITs industry, which experienced a 2.9% downturn. The recent decrease in share price, while aligned with current market sentiment, impacts the company's outlook as reflected in revenue and earnings forecasts. Analysts anticipate challenges in revenue growth due to economic headwinds, projecting a decrease of 1.6% annually over the next three years. Meanwhile, earnings are expected to grow to US$1.1 billion by April 2028, signaling cautious optimism.

Considering the share price's proximity to the analyst price target of US$165.0, which is 10.4% higher than the current level of US$147.84, there is potential for upward movement should anticipated earnings and revenue materialize as projected. However, the reliance on bridge loans and joint ventures may pose risks under fluctuating interest rates, affecting future earnings stability. It's crucial for investors to weigh these variables while forming a comprehensive view of the company's prospects in the face of broader market dynamics.

Evaluate Extra Space Storage's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal