Carrier Global (NYSE:CARR) Tackles Pharma Challenges With New Lynx FacTOR SaaS

Carrier Global (NYSE:CARR) introduced Carrier Lynx FacTOR, a cutting-edge SaaS solution targeting the pharmaceutical sector, aimed at improving product release processes. Despite this innovative product launch, the company's share price declined 13% over the last week, aligning closely with a broader 12% market downturn amid global trade tensions and newly imposed tariffs. Although the launch of Lynx FacTOR is a significant development, the market's overall volatility and the escalating trade conflicts appeared to have a more substantial influence on the stock's decline, weighing on investor sentiment across industries, including pharmaceuticals and broader technology sectors.

The introduction of Carrier Lynx FacTOR presents an exciting opportunity for Carrier Global as it seeks to enhance its footprint in the pharmaceutical sector. Despite recent share price declines linked to global trade tensions, analysts remain focused on the company's long-term growth potential. Over the past five years, Carrier Global has delivered a total shareholder return of 326.94%, a very large gain compared to its recent short-term movements. In contrast, over the past year, the company's share performance somewhat matched the broader trends affecting the US Building industry, illustrating the market's fluctuating nature.

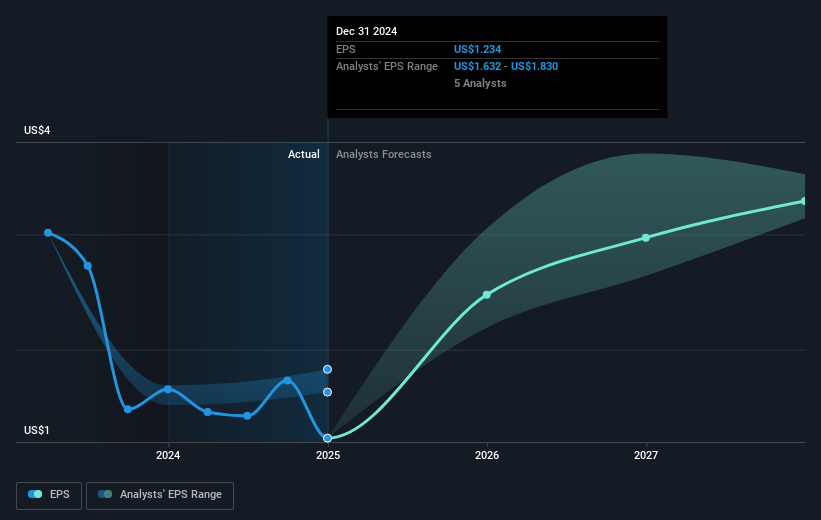

The potential revenue impact of Lynx FacTOR, alongside Carrier's expansion in home energy management in Europe, remains significant for future business growth. Revenue and earnings forecasts project growth rates of 4.3% annually for revenue and 16.98% for earnings. The share price, however, is trading at a discount to the consensus analyst price target of US$78.89, indicating potential upside. As long as operational risks and external challenges are effectively managed, Carrier's strategic initiatives could reinforce its market position and support the achievement of these forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal