Aflac (NYSE:AFL) Reports Earnings Growth With Revenue Reaching US$18,927 Million

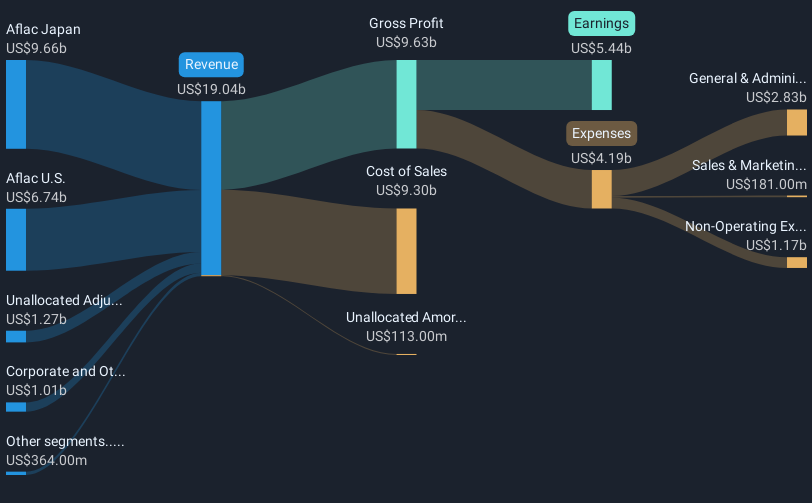

Aflac (NYSE:AFL) recently announced earnings growth for the full year ending in 2024, with revenue reaching $18,927 million and net income climbing to $5,443 million. Despite these positive results, the company's share price declined by 4% in the last quarter. This movement aligns with the broader market's volatility, which saw a 12% decline in response to heightened trade tensions and tariffs. During this period, Aflac's initiatives such as share buybacks and new product offerings likely offered support but did not prevent the stock from following broader market trends impacted by global economic uncertainties.

The recent earnings growth announcement by Aflac, despite the share price decline of 4% in the last quarter, has underscored broader market volatility and the company's grappling with external economic challenges. However, over the long term, Aflac shares have provided substantial returns of 198.42% over the last five years, reflecting strong financial management and shareholder value. Over the past year, Aflac has also outperformed the US Insurance industry, which returned 7.8%, and the broader US market, which experienced a 3.8% decline. This indicates resilient performance despite near-term market pressures.

The recent developments, including trade tensions and economic uncertainties, may impact future revenue and earnings forecasts, specifically in areas like U.S. dental and vision products amid heightened competition. Aflac’s shares currently show a slight discount of about 6.24% against the consensus price target of US$106. This alignment suggests that analysts generally view Aflac as fairly valued. The synchronous fluctuations between Aflac’s share price and the broader market imply potential global economic factors influencing revenue and earnings projections rather than a reflection of intrinsic business weaknesses.

Explore Aflac's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal