Beyond The Numbers: 8 Analysts Discuss Extra Space Storage Stock

8 analysts have shared their evaluations of Extra Space Storage (NYSE:EXR) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 4 | 0 | 0 |

| Last 30D | 0 | 2 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 3 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

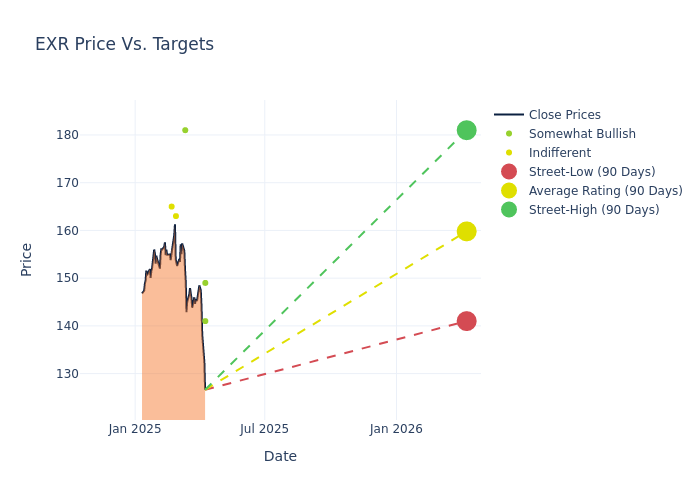

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $164.38, a high estimate of $184.00, and a low estimate of $141.00. This current average represents a 5.06% decrease from the previous average price target of $173.14.

Decoding Analyst Ratings: A Detailed Look

The perception of Extra Space Storage by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |--------------------|--------------------|---------------|-----------------|--------------------|--------------------| |Nicholas Yulico |Scotiabank |Lowers |Sector Outperform| $149.00|$165.00 | |Ravi Vaidya |Mizuho |Announces |Outperform | $141.00|- | |Brendan Lynch |Barclays |Lowers |Overweight | $181.00|$184.00 | |Nicholas Yulico |Scotiabank |Lowers |Sector Perform | $165.00|$167.00 | |Brad Heffern |RBC Capital |Lowers |Sector Perform | $163.00|$167.00 | |Eric Luebchow |Wells Fargo |Lowers |Equal-Weight | $165.00|$170.00 | |Brendan Lynch |Barclays |Lowers |Overweight | $184.00|$192.00 | |Nicholas Yulico |Scotiabank |Maintains |Sector Perform | $167.00|$167.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Extra Space Storage. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Extra Space Storage compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Extra Space Storage's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Extra Space Storage's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Extra Space Storage analyst ratings.

Delving into Extra Space Storage's Background

Extra Space Storage is a fully integrated real estate investment trust that owns, operates, and manages almost 4,000 self-storage properties in 42 states, with over 300 million net rentable square feet of storage space. Of these properties, approximately one half is wholly owned, while some facilities are owned through joint ventures and others are owned by third parties and managed by Extra Space Storage in exchange for a management fee.

Extra Space Storage: Delving into Financials

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Positive Revenue Trend: Examining Extra Space Storage's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 3.02% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: Extra Space Storage's net margin excels beyond industry benchmarks, reaching 31.89%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Extra Space Storage's ROE stands out, surpassing industry averages. With an impressive ROE of 1.88%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Extra Space Storage's ROA stands out, surpassing industry averages. With an impressive ROA of 0.92%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Extra Space Storage's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.93.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Wall Street Journal

Wall Street Journal