The Market Doesn't Like What It Sees From Elanco Animal Health Incorporated's (NYSE:ELAN) Revenues Yet As Shares Tumble 25%

Elanco Animal Health Incorporated (NYSE:ELAN) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

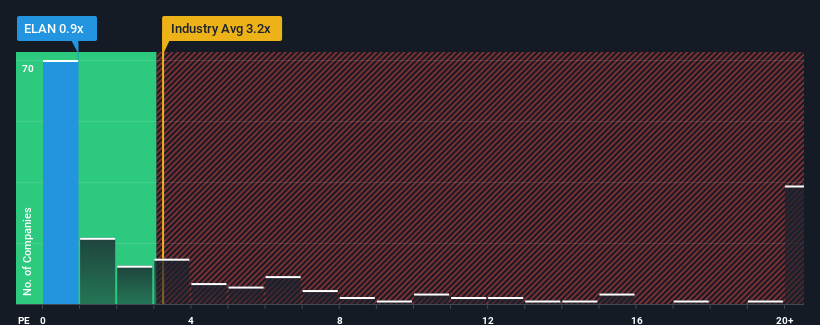

After such a large drop in price, Elanco Animal Health's price-to-sales (or "P/S") ratio of 0.9x might make it look like a strong buy right now compared to the wider Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios above 3.1x and even P/S above 12x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Elanco Animal Health

What Does Elanco Animal Health's P/S Mean For Shareholders?

Elanco Animal Health could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Elanco Animal Health .How Is Elanco Animal Health's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Elanco Animal Health's is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 6.8% decline in revenue over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 3.2% each year as estimated by the eleven analysts watching the company. With the industry predicted to deliver 19% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Elanco Animal Health's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Elanco Animal Health's P/S?

Shares in Elanco Animal Health have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Elanco Animal Health maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

You should always think about risks. Case in point, we've spotted 3 warning signs for Elanco Animal Health you should be aware of, and 2 of them are concerning.

If you're unsure about the strength of Elanco Animal Health's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal