The Market Doesn't Like What It Sees From USANA Health Sciences, Inc.'s (NYSE:USNA) Earnings Yet As Shares Tumble 25%

The USANA Health Sciences, Inc. (NYSE:USNA) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 47% in that time.

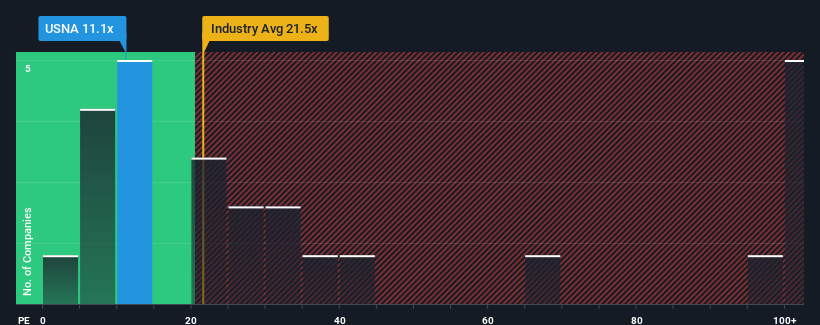

Since its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 16x, you may consider USANA Health Sciences as an attractive investment with its 11.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

While the market has experienced earnings growth lately, USANA Health Sciences' earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for USANA Health Sciences

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as USANA Health Sciences' is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 62% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 16% during the coming year according to the sole analyst following the company. Meanwhile, the broader market is forecast to expand by 14%, which paints a poor picture.

In light of this, it's understandable that USANA Health Sciences' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From USANA Health Sciences' P/E?

USANA Health Sciences' recently weak share price has pulled its P/E below most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that USANA Health Sciences maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - USANA Health Sciences has 1 warning sign we think you should be aware of.

If you're unsure about the strength of USANA Health Sciences' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Wall Street Journal

Wall Street Journal