Tradeweb Markets (NasdaqGS:TW) Reports Record Trading Volumes in Q1 2025 Despite Flat Share Price

Tradeweb Markets (NasdaqGS:TW) reported record trading volumes in March and the first quarter of 2025, yet the company's shares experienced a flat price movement over the last quarter. Despite achieving a significant year-over-year growth in Average Daily Volume, the broader market instability driven by tariff uncertainties may have tempered investor enthusiasm. The volatility in indices, with the Dow Jones seeing substantial swings due to tariff tensions, likely influenced investor sentiment across sectors, including Tradeweb. Despite the company's robust performance, external economic factors and fear of a recession in the market may have kept the stock's returns static for the period.

Find companies with promising cash flow potential yet trading below their fair value.

The recent news of Tradeweb Markets reaching record trading volumes comes amid broader market instability and tariff uncertainties, potentially impacting investor sentiment. Despite these challenges, the company has shown remarkable share performance over the longer term, with a total return of 181.24% over the past five years. This contrasts with more recent performance, where Tradeweb exceeded the US Capital Markets industry’s 2.9% return in the past year, highlighting its resilience and growth potential despite market volatility.

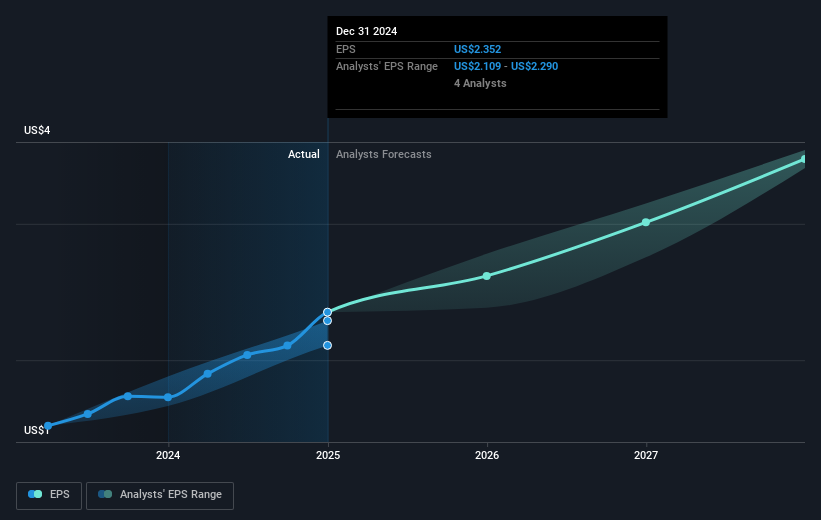

The partnership with BlackRock's Aladdin and investments in technology highlighted in the narrative may bolster future revenue and earnings forecasts, driving operational efficiency and market expansion efforts. Analysts forecast revenue and earnings to grow at 13.4% annually and to increase to $879.0 million, respectively, over the next few years. However, the flat share price movement compared to the analyst price target of US$146.07 suggests the market may already be pricing in these growth projections, with the current share price at US$147.95 representing a minor discount to the price target. As Tradeweb continues to expand its global footprint, it remains well-positioned to navigate any ongoing economic uncertainties, offering diverse electronic trading solutions.

Review our growth performance report to gain insights into Tradeweb Markets' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Wall Street Journal

Wall Street Journal